Business, 22.02.2020 02:58 quise2ross

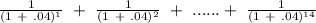

A bank offers you a $1M loan with an IRR of 4% (i. e. the bank makes a return of 4% on the loan). The bank requires you to repay the loan in 14 equal annual installments, starting next year.(a) What is the annual payment on the loan, to the nearest dollar

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 09:40, bennett2968

Boone brothers remodels homes and replaces windows. ace builders constructs new homes. if boone brothers considers expanding into new home construction, it should evaluate the expansion project using which one of the following as the required return for the project?

Answers: 1

Business, 22.06.2019 17:00, kiahbryant12

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

Business, 22.06.2019 20:00, jaylennkatrina929

Which of the following is a competitive benefit experienced by the first mover firm in an industry? a. the first mover will be able to achieve a less steep learning curve. b. the first mover will be able to reduce the switching costs. c. the first mover will not have to patent its products or technology. d. the first mover will be able to reduce costs through economies of scale.

Answers: 3

You know the right answer?

A bank offers you a $1M loan with an IRR of 4% (i. e. the bank makes a return of 4% on the loan). Th...

Questions in other subjects:

Mathematics, 15.11.2019 22:31

History, 15.11.2019 22:31

Mathematics, 15.11.2019 22:31

History, 15.11.2019 22:31

Mathematics, 15.11.2019 22:31

= 10.5631

= 10.5631