Business, 22.02.2020 00:21 AikawaAisyah2438

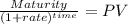

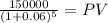

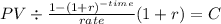

Ace Leasing acquires equipment and leases it to customers under long-term sales-type leases. Ace earns interest under these arrangements at a 6% annual rate. Ace leased a machine it purchased for $620,000 under an arrangement that specified annual payments beginning at the commencement of the lease for five years. The lessee had the option to purchase the machine at the end of the lease term for $150,000 when it was expected to have a residual value of $180,000. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Calculate the amount of the annual lease payments.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, meababy2009ow9ewa

1. gar principles or "the principles"are intended to do what? a. foster an awareness of the hierarchical structure of the organization b. explain the best method of implementing biometric security techniques c. foster an awareness of the importance of good employee training d. foster an awareness of getting upper level management on board in understanding the need to implement an ig program e. foster an awareness of good record keeping principles

Answers: 1

Business, 21.06.2019 22:50, jonlandis6

Synovec co. is growing quickly. dividends are expected to grow at a rate of 24 percent for the next three years, with the growth rate falling off to a constant 7 percent thereafter. if the required return is 11 percent, and the company just paid a dividend of $2.05, what is the current share price? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 2

Business, 21.06.2019 22:50, Zagorodniypolina5

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 22.06.2019 20:00, lusa0720

Edna gomez is the founder of the restaurant chain good and green. she ensures that the products in her stores are ethically and responsibly sourced. most products are therefore 100 percent organic and all packaging is manufactured from recycled material. also, her company sources ingredients from farms within 100 miles from her locations. edna's belief is that her restaurants should be able to support the community at large. which of the following terms best describes edna gomez? a. headhunter b. category captain c. social entrepreneur d. trade creditor

Answers: 3

You know the right answer?

Ace Leasing acquires equipment and leases it to customers under long-term sales-type leases. Ace ear...

Questions in other subjects:

Mathematics, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01

Business, 13.09.2020 14:01

History, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01

Social Studies, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01

Mathematics, 13.09.2020 14:01