Business, 21.02.2020 18:38 rleiphart1

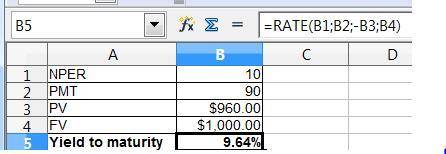

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 10 years to maturity. The bond carries an annual interest payment of $90 and is currently selling for $960. Airborne is in a 20 percent tax bracket. The firm wishes to know what the aftertax cost of a new bond issue is likely to be. The yield to maturity on the new issue will be the same as the yield to maturity on the old issue because the risk and maturity date will be similar.

Required:

a. Compute the yield to maturity on the old issue and use this as the yield for the new issue. (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

b. Make the appropriate tax adjustment to determine the aftertax cost of debt. (Do not round intermediate calculations.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 13:50, brewerroserb

Ateam of engineers has decided to design a new shoe for people suffering from a painful foot condition. what should the engineers do during the planning stage of their project? a. look at the trial's results to see how the design can be improved. b. build a variety of shoe models. c. have patients wear the new shoe in an experimental trial to see if symptoms improve. d. estimate how much potential consumers would be willing to pay for this new shoe.

Answers: 1

Business, 22.06.2019 17:50, hinokayleen5053

Which of the following is an element of inventory holding costs? a. material handling costs b. investment costs c. housing costs d. pilferage, scrap, and obsolescence e. all of the above are elements of inventory holding costs.

Answers: 1

Business, 22.06.2019 18:00, claftonaustin846

Your subscription to investing wisely weekly is about to expire. you plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $620, also payable immediately. assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

Answers: 2

Business, 22.06.2019 20:30, Picklehead1166

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

You know the right answer?

Airborne Airlines Inc. has a $1,000 par value bond outstanding with 10 years to maturity. The bond c...

Questions in other subjects:

Physics, 03.12.2020 20:20

Chemistry, 03.12.2020 20:20

Mathematics, 03.12.2020 20:20