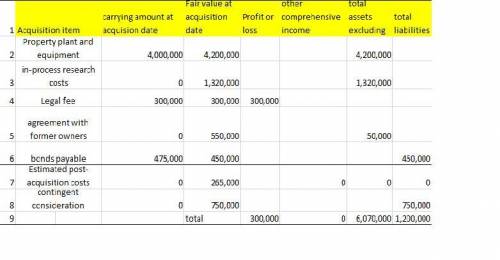

FB Corp. prepares its financial statements in accordance with IFRS. FB acquired 100% of the outstanding common stock of Skarlet, Inc. for $5,500,000. The purchase price included $300,000 to reimburse the former shareholders of Skarlet for legal fees incurred to complete the acquisition. The company also agreed to pay the seller an additional $1,500,000 if Skarlet generated $5,000,000 in net earnings during the first two years after the acquisition. At the acquisition date, the fair value of the contingent consideration was $750,000.

For each of the acquisition items, enter the amount that should be reflected in the line item of FB's consolidated financial statements as of the acquisition date. Enter debit balances as positive values and credit balances as negative values. If an item is not included in any line item, enter zeros in each cell of the associated row.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:00, allisonklinger1786

Need with my trade theory homework. i doubt what i wrote was right. consider a monopolistically competitive market for soft drinks in which n symmetric firms face the following demand function: q=s(1/n-b(p-(p with the straight line on which implies the marginal revenue functionmr=p-(q/sb)finally, suppose firms face the total cost functiontc=900,000+100qsuppose the market size, s, is 27,000,000, and the elasticity parameter b is 0.003.diagram the price and the average total cost in the market as a function of the number of firms. what are the equations for each curve, and why does each curve slope up or down? label the equilibrium number of firms and the equilibrium price in the diagram. why is this the equilibrium?

Answers: 1

Business, 22.06.2019 11:20, angeline2004

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard deviation of 25%. portfolio p has $200,000 consisting of $100,000 invested in stock a and $100,000 in stock b. which of the following statements is correct? (assume that the stocks are in equilibrium.) (a) stock b has a higher required rate of return than stock a. (b) portfolio p has a standard deviation of 22.5%. (c) portfolio p has a beta equal to 1.0. (d) more information is needed to determine the portfolio's beta. (e) stock a's returns are less highly correlated with the returns on most other stocks than are b's returns.

Answers: 3

Business, 22.06.2019 11:40, taylor825066

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x, y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

You know the right answer?

FB Corp. prepares its financial statements in accordance with IFRS. FB acquired 100% of the outstand...

Questions in other subjects:

Mathematics, 26.08.2019 09:10

Social Studies, 26.08.2019 09:10

Mathematics, 26.08.2019 09:10

Social Studies, 26.08.2019 09:10