Business, 20.02.2020 18:26 sakria2002

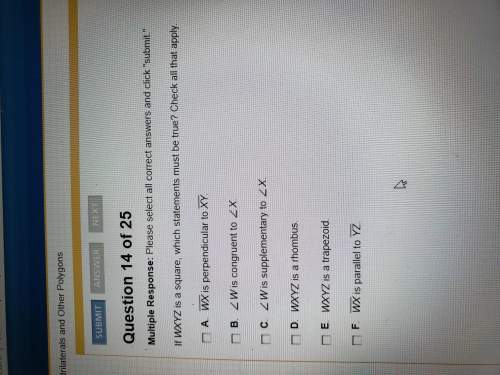

According to the following table, what is her hypothetical credit score?

Under 25 2-29 30-34 35-39

45-49

40-44

50 or over

Are

48

20

88

124

1 yr

2-3 yrs

4-5 yrs

|<1 yr

36

10+ yrs

Time at address

6-9 yrs

20

5-7 yrs

None

0-1 yrs

2 yrs

3 - 4 yrs

8 + yrs

Age of auto

48

64

52

None

< $125

$126 - $150

9151 - $199

S200+

Car payment

24

< $274

$275 - $399

$400 +

Owns clear Lives w/reatives

Housing costs

40

48

Both

Checking only

Savings only

Neither

Checking and savings accounts

60

Yes

Finance company reference

Major credit cards

Ratio of debt income

None

2 or more

20

No debts i 1%-5% 6%-15%

164

Never in the last 10 yrs Over 10 yrs ago,

16% over

Declared bankruptcy

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:50, ShawnSaviro4918

In december of 2004, the company you own entered into a 20-year contract with a grain supplier for daily deliveries of grain to its hot dog bun manufacturing facility. the contract called for "10,000 pounds of grain" to be delivered to the facility at the price of $100,000 per day. until february 2017, the supplier provided processed grain which could easily be used in your manufacturing process. however, no longer wanting to absorb the cost of having the grain processed, the supplier began delivering whole grain. the supplier is arguing that the contract does not specify the type of grain that would be supplied and that it has not breached the contract. your company is arguing that the supplier has an onsite processing plant and processed grain was implicit to the terms of the contract. over the remaining term of the contract, reshipping and having the grain processed would cost your company approximately $10,000,000, opposed to a cost of around $1,000,000 to the supplier. after speaking with in-house counsel, it was estimated that litigation would cost the company several million dollars and last for years. weighing the costs of litigation, along with possible ambiguity in the contract, what are three options you could take to resolve the dispute? which would be the best option for your business and why?

Answers: 2

Business, 22.06.2019 08:40, Damagingawsomeness2

Gerda, a real estate agent, is selling a moderately priced house in a subdivision. she knows from her uncle that the factory being built half a mile from the subdivision will be manufacturing dog food, using a process that creates a very strong odor that permeates the surrounding neighborhood. a buyer, who is unaware of the type of factory under construction, makes an offer on one of the houses gerda is selling, and within a short time, the deal goes through. what does this scenario best illustrate?

Answers: 3

Business, 22.06.2019 10:50, iaminu50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

Business, 22.06.2019 11:10, jordanbyrd33

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

You know the right answer?

According to the following table, what is her hypothetical credit score?

Under 25 2-29 30-34 3...

Under 25 2-29 30-34 3...

Questions in other subjects:

Computers and Technology, 05.01.2021 18:10

Mathematics, 05.01.2021 18:10

English, 05.01.2021 18:10

Social Studies, 05.01.2021 18:10