Business, 18.02.2020 22:32 karebareyo

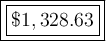

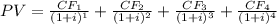

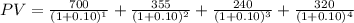

Many financial decisions require the analysis of uneven, or nonconstant: cash flows stock dividends typically increase over time and investments in capital equipment almost always generate uneven cash flows. The term cash flow (CFt) denotes cash flows, while payment (PMT) designates cash flows coming at regular intervals The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: PV = Similarly, the future value of an uneven cash flow stream is the sum of the FVs of the individual cash flows. Many calculators have an NFV key that lets you obtain the FV. However, if your calculator doesn't have a net future value (NFV) key, you can calculate the NFV as follows: NFV-NPV × (1+1) One can also find the interest rate of the uneven cash flow stream with a financial calculator and solving Quantitative Problem: You own a security with the cash flows shown below 700 355 240 320 If you equire an annual retum of 10%, what is the present value of this cash flow stream? Round your answer to the nearest cent. Do not round intermediate calculations.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:20, AquaNerd5706

Aproduction order quantity problem has a daily demand rate = 10 and a daily production rate = 50. the production order quantity for this problem is approximately 612 units. what is the average inventory for this problem?

Answers: 1

Business, 22.06.2019 10:20, christianconklin22

The following information is for alex corp: product x: revenue $12.00 variable cost $4.50 product y: revenue $44.50 variable cost $9.50 total fixed costs $75,000 what is the breakeven point assuming the sales mix consists of two units of product x and one unit of product y?

Answers: 3

Business, 22.06.2019 11:40, taylor825066

Define the marginal rate of substitution between two goods (x and y). if a consumer’s preferences are given by u(x, y) = x3/4y1/4, compute the consumer’s marginal rate of substitution as a function of x and y. calculate the mrs if the consumer has chosen to consumer 48 units of x and 16 units of y. show your work. (use the back of the page if necessary.

Answers: 3

You know the right answer?

Many financial decisions require the analysis of uneven, or nonconstant: cash flows stock dividends...

Questions in other subjects:

Mathematics, 18.02.2020 05:10

Biology, 18.02.2020 05:10

Mathematics, 18.02.2020 05:10