Business, 17.02.2020 16:59 IDespretlyneedhelp

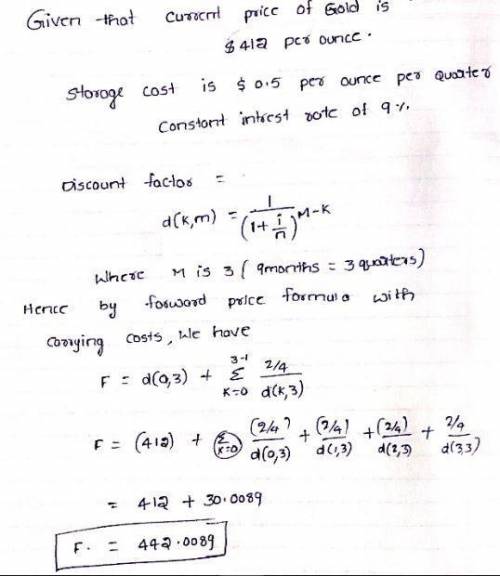

The current price of gold is $ 412 per ounce. The storage cost is $ 0.5 per ounce per quarter, payable quarterly in advance. Assuming a constant interest rate of 9 percent, compounded quarterly, what is the theoretical forward price of gold for delivery in 9 months?Hint: F=Sd(0,M)+∑k=M−1k=0c(k)d(k, M)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:00, tylerineedhelp

The market yield on spice grills' bonds is 15%, and the firm's marginal tax rate is 33%. what is their shareholders' required return if the equity risk premium is 4%?

Answers: 1

Business, 22.06.2019 21:00, sofiaisabelaguozdpez

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

Business, 22.06.2019 23:30, autumnsusan190ox9kn4

Decision alternatives should be identified before decision criteria are established. are limited to quantitative solutions are evaluated as a part of the problem definition stage. are best generated by brain-storming.

Answers: 1

You know the right answer?

The current price of gold is $ 412 per ounce. The storage cost is $ 0.5 per ounce per quarter, payab...

Questions in other subjects:

Geography, 09.10.2019 23:30

Mathematics, 09.10.2019 23:30

Mathematics, 09.10.2019 23:30

English, 09.10.2019 23:30