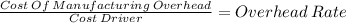

At the beginning of the year, Glaser Company estimated the following: Assembly Department Testing Department Total Overhead $702,000 $786,240 $1,488,240 Direct labor hours 77,000 95,480 172,480 Machine hours 95,500 68,760 164,260 Glaser uses departmental overhead rates. In the assembly department, overhead is applied on the basis of direct labor hours. In the testing department, overhead is applied on the basis of machine hours. Actual data for the month of March are as follows: Assembly Department Testing Department Total Overhead $91,260 $102,211 $193,471 Direct labor hours 10,010 12,412 22,422 Machine hours 12,415 8,939 21,354 Required: Calculate the predetermined overhead rates for the assembly and testing departments.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 12:00, ambercombs

Suppose there are three types of consumers who attend concerts at your university’s performing arts center: students, staff, and faculty. each of these groups has a different willingness to pay for tickets; within each group, willingness to pay is identical. there is a fixed cost of $1,000 to put on a concert, but there are essentially no variable costs. for each concert: i. there are 140 students willing to pay $20. (ii) there are 200 staff members willing to pay $35. (iii) there are 100 faculty members willing to pay $50. a) if the performing arts center can charge only one price, what price should it charge? what are profits at this price? b) if the performing arts center can price discriminate and charge two prices, one for students and another for faculty/staff, what are its profits? c) if the performing arts center can perfectly price discriminate and charge students, staff, and faculty three separate prices, what are its profits?

Answers: 1

Business, 22.06.2019 16:30, natalie2sheffield

En major recording acts are able to play at the stadium. if the average profit margin for a concert is $175,000, how much would the stadium clear for all of these events combined?

Answers: 3

Business, 23.06.2019 00:10, miller3009

During the current year, luis university received a $50,000 gift from an alumna who specified that it must be used to pay travel costs for faculty to attend health care conferences in foreign countries. during the year the university spent $8,000 to support travel to a health care conference in italy. the $8,000 disbursement will cause a net decrease in which class of net assets?

Answers: 1

You know the right answer?

At the beginning of the year, Glaser Company estimated the following: Assembly Department Testing De...

Questions in other subjects:

Health, 17.10.2019 18:30

English, 17.10.2019 18:30

Social Studies, 17.10.2019 18:30

History, 17.10.2019 18:30

Mathematics, 17.10.2019 18:30

Mathematics, 17.10.2019 18:30