Business, 13.02.2020 00:21 destinywashere101

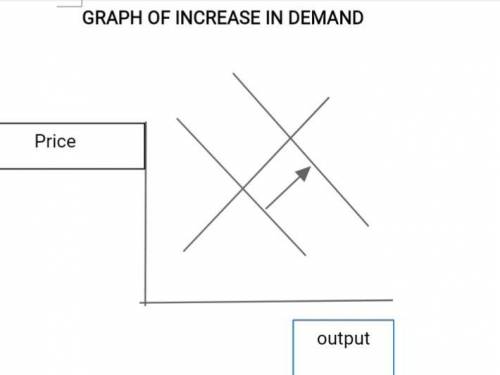

After World War I in 1945, the United States experienced a "baby boom" as birthrates rose and remained high through the early 1960s. In 2011, the first members o the baby boom generation became older than 65. What effect willthis have on the market for hospital facilities? As the first baby boomers become older than 65, the

0 A, demand curve for hospital facilities will shift to the right.

O B. demand curve for hospital facilities will become vertical

O C. demand curve for hospital facilities will shift to the left

O D. supply curve for hospital facilities will shift to the right

O E. quantity of hospital facilities demanded will increase.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 12:00, DeathFightervx

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

Business, 22.06.2019 16:00, angelinaranee15

In a perfectly competitive market, the long-run market supply curve tends to be horizontal or nearly so. what is another way to state this fact? (a) market supply is much more elastic in the long run than the short run. (b) in the long run, average total cost is minimized. (c) in the long run, price equals marginal cost. (d) market supply is much less elastic in the long run than the short run.

Answers: 1

Business, 22.06.2019 17:40, libi052207

Turrubiates corporation makes a product that uses a material with the following standards standard quantity 8.0 liters per unit standard price $2.50 per liter standard cost $20.00 per unit the company budgeted for production of 3,800 units in april, but actual production was 3,900 units. the company used 32,000 liters of direct material to produce this output. the company purchased 20,100 liters of the direct material at $2.6 per liter. the direct materials purchases variance is computed when the materials are purchased. the materials quantity variance for april is:

Answers: 1

Business, 22.06.2019 20:10, janayflowers042

Russell's is considering purchasing $697,400 of equipment for a four-year project. the equipment falls in the five-year macrs class with annual percentages of .2, .32, .192, .1152, .1152, and .0576 for years 1 to 6, respectively. at the end of the project the equipment can be sold for an estimated $135,000. the required return is 13.2 percent and the tax rate is 23 percent. what is the amount of the aftertax salvage value of the equipment assuming no bonus depreciation is taken

Answers: 2

You know the right answer?

After World War I in 1945, the United States experienced a "baby boom" as birthrates rose and remain...

Questions in other subjects:

Chemistry, 27.10.2020 19:10

History, 27.10.2020 19:10

Biology, 27.10.2020 19:10

Mathematics, 27.10.2020 19:10

History, 27.10.2020 19:10

Physics, 27.10.2020 19:10