Business, 12.02.2020 05:27 TMeansStupidity

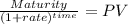

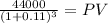

On January 1, 2018, Byner Company purchased a used tractor Byner paid $3,000 down and signed a noninterest-bearing note requiring $44,000 to be paid on December 31, 2020. The fair value of the tractor is not determinable. An interest rate of11% property reflects the time value of money for this type of loan agreement. The company's fiscal year-end is December 31.

Required:

1. Prepare the journal entry to record the acquisition of the tractor.

2. How much interest expense will the company include in its 2018 and 2019 income statements for this note?

3. What is the amount of the liability the company will report in its 2018 and 2019 balance sheets for this note?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:00, stevend0599

What is overdraft protection (odp)? a.) a cheap and easy way to always avoid overdrawing a bank account b.) a service to automatically transfer available funds from a linked account to cover purchases, prevent returned checks and declined items when you don’t have enough money in your checking account at the time of the transaction. c.) an insurance policy sold by banks to prevent others from withdrawing your money d.) a service provided by the government that insures individuals bank deposits up to $250,000

Answers: 2

Business, 22.06.2019 20:20, baby851

You are the cfo of a u. s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u. s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 22.06.2019 20:20, Hi123the

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

On January 1, 2018, Byner Company purchased a used tractor Byner paid $3,000 down and signed a nonin...

Questions in other subjects:

Mathematics, 06.04.2021 04:40

World Languages, 06.04.2021 04:40

Mathematics, 06.04.2021 04:40

Mathematics, 06.04.2021 04:40