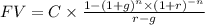

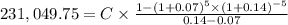

Anderson Manufacturing Co., a small fabricator of plastics, needs to purchase an extrusion molding machine for $120,000. Kersey will borrow money from a bank at an interest rate of 14% over five years. Anderson expects its product sales to be slow during the first year, but to increase subsequently at an annual rate of 7%. Anderson therefore arranges with the bank to pay off the loan on a"balloon scale," which results in the lowest payment at the end of the first year and each subsequent payment being just 7% over the previous one. Determine the five annual payments.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:50, Taiyou

The u. s. stock market has returned an average of about 9% per year since 1900. this return works out to a real return (i. e., adjusted for inflation) of approximately 6% per year. if you invest $100,000 and you earn 6% a year on it, how much real purchasing power will you have in 30 years?

Answers: 2

Business, 22.06.2019 07:30, edna27

When the national economy goes from bad to better, market research shows changes in the sales at various types of restaurants. projected 2011 sales at quick-service restaurants are $164.8 billion, which was 3% better than in 2010. projected 2011 sales at full-service restaurants are $184.2 billion, which was 1.2% better than in 2010. how will the dollar growth in quick-service restaurants sales compared to the dollar growth for full-service places?

Answers: 2

Business, 22.06.2019 09:50, winterblanco

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Business, 22.06.2019 13:40, LilFabeOMM5889

The cook corporation has two divisions--east and west. the divisions have the following revenues and expenses: east west sales $ 603,000 $ 506,000 variable costs 231,000 300,000 traceable fixed costs 151,500 192,000 allocated common corporate costs 128,600 156,000 net operating income (loss) $ 91,900 $ (142,000 ) the management of cook is considering the elimination of the west division. if the west division were eliminated, its traceable fixed costs could be avoided. total common corporate costs would be unaffected by this decision. given these data, the elimination of the west division would result in an overall company net operating income (loss)

Answers: 1

You know the right answer?

Anderson Manufacturing Co., a small fabricator of plastics, needs to purchase an extrusion molding m...

Questions in other subjects:

Mathematics, 19.04.2021 16:40

Engineering, 19.04.2021 16:50

Mathematics, 19.04.2021 16:50

Mathematics, 19.04.2021 16:50