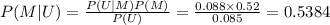

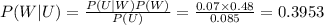

A recent study shows that unemployment does not impact males and females in the same way (Newsweek, April 20, 2009). According to a Bureau of Labor Statistics report, 8.5% of those who are eligible to work are unemployed. The unemployment rate is 8.8% for eligible men and only 7.0% for eligible women. Suppose 52% of the eligible workforce in the U. S. consists of men. a. You have just heard that another worker in a large firm has been laid off. What is the probability that this worker is a man?b. You have just heard that another worker in a large firm has been laid off. What is the probability that this worker is a woman?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:00, bryceisabeast6206

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 17:00, martinez6221

Vincent is interested in increasing his earning potential upon completing his internship at a major accounting firm. which option can immediately boost his career in the intended direction? b. complete a certification from a professional organization c. complete a new four-year undergraduate program in a related field d. complete a two-year associate degree in a related field e. complete an online course in accounting

Answers: 3

Business, 22.06.2019 20:40, ninjaben

On january 1, 2017, pharoah company issued 10-year, $2,020,000 face value, 6% bonds, at par. each $1,000 bond is convertible into 16 shares of pharoah common stock. pharoah’s net income in 2017 was $317,000, and its tax rate was 40%. the company had 97,000 shares of common stock outstanding throughout 2017. none of the bonds were converted in 2017. (a) compute diluted earnings per share for 2017. (round answer to 2 decimal places, e. g. $2.55.) diluted earnings per share

Answers: 3

You know the right answer?

A recent study shows that unemployment does not impact males and females in the same way (Newsweek,...

Questions in other subjects:

Mathematics, 17.09.2020 04:01

Mathematics, 17.09.2020 04:01

Mathematics, 17.09.2020 04:01

Mathematics, 17.09.2020 04:01

English, 17.09.2020 04:01

French, 17.09.2020 04:01

English, 17.09.2020 04:01

English, 17.09.2020 04:01

Mathematics, 17.09.2020 04:01

Mathematics, 17.09.2020 04:01