Business, 11.02.2020 01:45 aspenwheeler6804

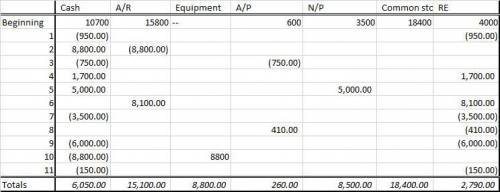

Grant Appraisal Service provides commercial and industrial appraisals and feasibility studies. On January 1, the assets and liabilities of the business were the following:Cash $10,700Accounts Receivable 15,800Accounts Payable 600Notes Payable 3,500Common Stock 18,400Retained Earnings 4,000The following transactions occurred during the month of January:Jan:

1 Paid rent for January, $950.2 Received $8,800 payment on customers' accounts.3 Paid $750 on accounts payable.4 Received $1,700 for services performed for cash customers.5 Borrowed $5,000 from a bank and signed a note payable for that amount.6 Billed the city $6,200 for a feasibility study performed; billed various other credit customers, $1,900.7 Paid the salary of an assistant, $3,500.8 Received invoice for January utilities, $410.9 Paid $6,000 cash for employee salaries.10 Purchased a van (on January 31) for business use, $8,800.11 Paid $150 to bank as January interest on the outstanding note payable. Required:(a) Set up an accounting equation in columnar form with the following individual assets, liabilities, and stockholders' equity accounts: Cash, Accounts Receivable, Van, Accounts Payable, Notes Payable, Common Stock, and Retained Earnings. Enter the January 1 balances below each item.(Note: The beginning Van account balance is $0.)(b) Show the impact (increase or decrease) of transactions 1-11 on the beginning balances, and total the columns to show that assets equal liabilities plus stockholders' equity as of January 31.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:30, qiuedhg

Consumer surplus is: the difference between the price of a product and what consumers were willing to pay for the product. the difference between the discounted price of a product and its retail price. the difference between the price paid by consumers and the price required of producers. the difference between the price of a product and consumers' valuation of the last unit of the product purchased.

Answers: 2

Business, 22.06.2019 01:00, taee67

Paar corporation bought 100 percent of kimmel, inc., on january 1, 2012. on that date, paar’s equipment (10-year life) has a book value of $420,000 but a fair value of $520,000. kimmel has equipment (10-year life) with a book value of $272,000 but a fair value of $400,000. paar uses the equity method to record its investment in kimmel. on december 31, 2014, paar has equipment with a book value of $294,000 but a fair value of $445,200. kimmel has equipment with a book value of $190,400 but a fair value of $357,000. the consolidated balance for the equipment account as of december 31, 2014 is $574,000. what would be the impact on consolidated balance for the equipment account as of december 31, 2014 if the parent had applied the initial value method rather than the equity method? the balance in the consolidated equipment account cannot be determined for the initial value method using the information given. the consolidated equipment account would have a higher reported balance. the consolidated equipment account would have a lower reported balance. no effect: the method the parent uses is for internal reporting purposes only and has no impact on consolidated totals.

Answers: 2

Business, 22.06.2019 08:30, bartonamber4042

What has caroline's payment history been like? support your answer with two examples

Answers: 3

Business, 22.06.2019 20:40, lulustar13

David consumes two things: gasoline (g) and bread (b). david's utility function is u(g, b) = 10g^0.25 b^0.75. use the lagrange technique to solve for david's optimal choices of gasoline and bread as a function of the price of gasoline, p_g, the price of bread, p_b, and his income m. with recent decrease in the price of gasoline (maybe due to external shock such as shale gas production) does david increase his consumption of gasoline? for david, how does partial differential g/partial differential p_g depend on his income m? that is, how does david's change in gasoline consumption due to an increase in the price of gasoline depend on his income level? to answer these questions, find the cross-partial derivative, |partial differential^2 g/partial differential m partial differential p_g.

Answers: 1

You know the right answer?

Grant Appraisal Service provides commercial and industrial appraisals and feasibility studies. On Ja...

Questions in other subjects:

Mathematics, 17.09.2019 03:10

Mathematics, 17.09.2019 03:10

English, 17.09.2019 03:10

Social Studies, 17.09.2019 03:10

Mathematics, 17.09.2019 03:10

Social Studies, 17.09.2019 03:10