Business, 25.01.2020 01:31 cylertroutner

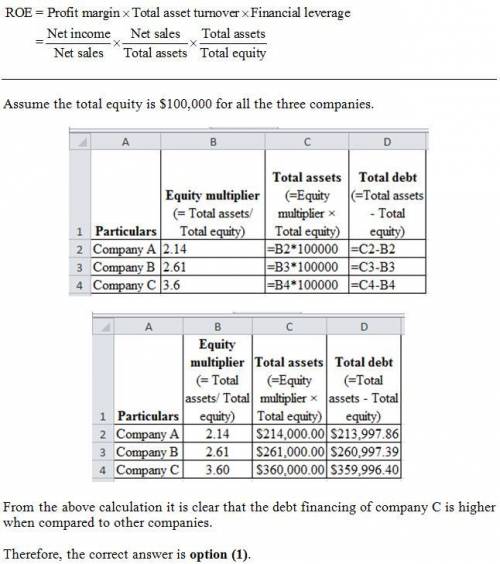

Corporate decision makers and analysts often use a particular technique, called a dupont analysis, to better understand the factors that drive a company's financial performance, as reflected by its return on equity (roe). by using the dupont equation, which disaggregates the roe into three components, analysts can see why a company's roe may have changed for the better or worse, and identify particular company strengths and weaknesses the dupont equation a dupont analysis is conducted using the dupont equation, which to identify and analyze three important factors that drive a company's roe. according to the equation, which of the following factors directly affect a company's roe? check all that apply price per share earnings per share sales / total assets net income/ sales most investors and analysts in the financial community pay particular attention to a company's roe. the roe can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the roe. investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. an analyst gathered the following data and calculated the various terms of the dupont equation for three companies: roe 12.0% 15.5% 21.5% profit margin x total assets turnover x equity multiplier company a company b company c 57.3% 58.2% 58.0% 9.8 10.2 10.3 2.14 2.61 3.60 referring to these data, which of the following conclusions will be true about the companies' roes? o the main driver of company a's inferior roe, as compared to that of company b's and company c's roe, is its use of higher debt financing o the main driver of company a's inferior roe, as compared to that of company c's roe, is its higher total asset turnover ratio the main driver of company c's superior roe, as compared to that of company a's and company b's roe, is its greater use of debt financing

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:00, kortlen4808

mary's baskets company expects to manufacture and sell 30,000 baskets in 2019 for $5 each. there are 4,000 baskets in beginning finished goods inventory with target ending inventory of 4,000 baskets. the company keeps no work-in-process inventory. what amount of sales revenue will be reported on the 2019 budgeted income statement?

Answers: 2

Business, 22.06.2019 10:20, alayciaruffin076

What two things do you consider when evaluating the time value of money

Answers: 1

Business, 22.06.2019 11:30, khynia11

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 11:30, laylay120

You've arrived at the pecan shellers conference—your first networking opportunity. naturally, you're feeling nervous, but to avoid seeming insecure or uncertain, you've decided to a. speak a little louder than you would normally. b. talk on your cell phone as you walk around. c. hold an empowered image of yourself in your mind. d. square your shoulders before entering the room.

Answers: 2

You know the right answer?

Corporate decision makers and analysts often use a particular technique, called a dupont analysis, t...

Questions in other subjects:

Mathematics, 05.07.2019 20:30

Health, 05.07.2019 20:30

English, 05.07.2019 20:30

Health, 05.07.2019 20:30