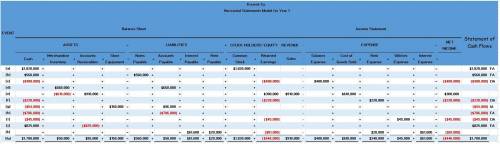

Use the horizontal model, or write the journal entry, for each of the following transactions and adjustments that occurred during the first year of operations at kissick co. issued 260,000 shares of $7-par-value common stock for $1,820,000 in cash. borrowed $560,000 from oglesby national bank and signed a 11% note due in two years. incurred and paid $400,000 in salaries for the year. purchased $660,000 of merchandise inventory on account during the year. sold inventory costing $610,000 for a total of $970,000, all on credit. paid rent of $220,000 on the sales facilities during the first 11 months of the year. purchased $150,000 of store equipment, paying $54,000 in cash and agreeing to pay the difference within 90 days. paid the entire $96,000 owed for store equipment and $610,000 of the amount due to suppliers for credit purchases previously recorded. incurred and paid utilities expense of $45,000 during the year. collected $825,000 in cash from customers during the year for credit sales previously recorded. at year-end, accrued $61,600 of interest on the note due to oglesby national bank. at year-end, accrued $20,000 of past-due december rent on the sales facilities.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 17:10, miguelc2145

At the beginning of the accounting period, nutrition incorporated estimated that total fixed overhead cost would be $50,600 and that sales volume would be 10,000 units. at the end of the accounting period actual fixed overhead was $56,100 and actual sales volume was 11,000 units. nutrition uses a predetermined overhead rate and a cost plus pricing model to establish its sales price. based on this information the overhead spending variance is multiple choice $5,500 favorable. $440 favorable. $5,500 unfavorable. $440 unfavorable.

Answers: 3

Business, 21.06.2019 19:20, 2020IRodriguez385

What impact did the economic opportunities in pennsylvania and new york have on virginia? a. virginia planters started to migrate to new york. b. new yorkers began buying up cheap virginia real estate. c. virginians found themselves resorting increasingly to slavery. d. virginians loosened their slave laws to attract more migrants.

Answers: 2

Business, 22.06.2019 01:00, staffordkimberly

Who is better at multi-tasking? in business, employees are often asked to perform a complex task when their atten-tion is divided (i. e., multi-tasking). human factors (may 2014) published a study designed to determine whether video game players are better than non–video game play-ers at multi-tasking. each in a sample of 60 college stu-dents was classified as a video game player or a non-player. participants entered a street crossing simulator and were asked to cross a busy street at an unsigned intersec-tion. the simulator was designed to have cars traveling at various high rates of speed in both directions. during the crossing, the students also performed a memory task as a distraction. two variables were measured for each student: (1) a street crossing performance score (measured out of 100 points) and (2) a memory task score (measured out of 20 points). the researchers found no differences in either the street crossing performance or memory task score of video game players and non-gamers. “these results,” say the researchers, “suggest that action video game players [and non-gamers] are equally susceptible to the costs of dividing attention in a complex task”

Answers: 1

Business, 22.06.2019 12:40, abilovessoftball

Which of the following tasks would be a line cook's main responsibility? oa. frying french fries ob. chopping onions oc. taking inventory of stocked dry goods od. paying invoices

Answers: 2

You know the right answer?

Use the horizontal model, or write the journal entry, for each of the following transactions and adj...

Questions in other subjects:

Geography, 17.09.2019 09:30

Mathematics, 17.09.2019 09:30

Biology, 17.09.2019 09:30

Mathematics, 17.09.2019 09:30

Arts, 17.09.2019 09:30

Biology, 17.09.2019 09:30

Social Studies, 17.09.2019 09:30