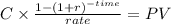

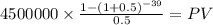

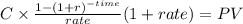

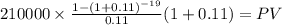

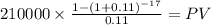

On the last day of its fiscal year ending december 31, 2018, the sedgwick & reams (s& r) glass company completed two financing arrangements. the funds provided by these initiatives will allow the company to expand its operations. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.)1. s& r issued 9% stated rate bonds with a face amount of $100 million. the bonds mature on december 31, 2036 (20 years). the market rate of interest for similar bond issues was 10% (5.0% semiannual rate). interest is paid semiannually (4.5%) on june 30 and december 31, beginning on june 30, 2019.2. the company leased two manufacturing facilities. lease a requires 20 annual lease payments of $210,000 beginning on january 1, 2019. lease b also is for 20 years, beginning january 1, 2019. terms of the lease require 17 annual lease payments of $230,000 beginning on january 1, 2022. generally accepted accounting principles require both leases to be recorded as liabilities for the present value of the scheduled payments. assume that an 11% interest rate properly reflects the time value of money for the lease obligations. required: what amounts will appear in s& r's december 31, 2018, balance sheet for the bonds and for the leases? (enter your answers in whole dollars. do not round intermediate calculations. round your final answers to nearest whole dollar amount.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, hollie52

The market price of cheeseburgers in a college town increased recently, and the students in an economics class are debating the cause of the price increase. some students suggest that the price increased because the price of beef, an important ingredient for making cheeseburgers, has increased. other students attribute the increase in the price of cheeseburgers to a recent increase in college student enrollment.1. the first group of students thinks the increase in the price of cheeseburgers is due to the fact that the price of beef, an important ingredient for making cheeseburgers, has increased. (what happened to demand and supply, shift to the right or left)2. the second group of students attributes the increase in the price of cheeseburgers to the increase in college student enrollment. (what happens to demand and supply, shift to the right or left)3. suppose that both of the events you analyzed above are partly responsible for the increase in the price of cheeseburgers. based on your analysis of the explanations offered by the two groups of students, how would you figure out which of the possible causes was the dominant cause of the increase in the price of cheeseburgers? (choose a, b, c, or d)a)if the price increase was small, then the supply shift in the market for cheeseburgers must have been larger than the demand shift. b)if the equilibrium quantity of cheeseburgers decreases, then the demand shift in the market for cheeseburgers must have been larger than the supply shift. c)if the equilibrium quantity of cheeseburgers decreases, then the supply shift in the market for cheeseburgers must have been larger than the demand shift. d)whichever change occurred first must have been the primary cause of the change in the price of cheeseburgers.

Answers: 2

Business, 21.06.2019 23:20, pwolfiimp4

Which feature transfers a slide show into a word-processing document?

Answers: 2

Business, 22.06.2019 01:00, reagriffis24

How does the economy of cuba differ from the economy of north korea? in north korea, the government’s control of the economy has begun to loosen. in cuba, the government maintains a tight hold over the economy. in cuba, the government’s control of the economy has begun to loosen. in north korea, the government maintains a tight hold over the economy. in north korea, there is economic uncertainty in exchange for individual choice. in cuba, there is economic security in exchange for government control. in cuba, there is economic uncertainty in exchange for individual choice. in north korea, there is economic security in exchange for government control.\

Answers: 2

Business, 22.06.2019 12:30, chycooper101

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

You know the right answer?

On the last day of its fiscal year ending december 31, 2018, the sedgwick & reams (s& r) gl...

Questions in other subjects:

English, 16.09.2019 06:20

Health, 16.09.2019 06:20

Mathematics, 16.09.2019 06:20

Physics, 16.09.2019 06:20

Geography, 16.09.2019 06:20

English, 16.09.2019 06:20

Business, 16.09.2019 06:20