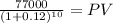

Amachine purchased three years ago for $317,000 has a current book value using straight-line depreciation of $188,000; its operating expenses are $37,000 per year. a replacement machine would cost $227,000, have a useful life of ten years, and would require $9,000 per year in operating expenses. it has an expected salvage value of $77,000 after ten years. the current disposal value of the old machine is $86,000; if it is kept 10 more years, its residual value would be $13,000.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:50, emmanuelcampbel

What happens when a bank is required to hold more money in reserve?

Answers: 3

Business, 22.06.2019 07:30, alexanderavrett

Awell-written business plan can improve your chances of getting funding and give you more free time. improved logistics. greater negotiating power.

Answers: 1

Business, 22.06.2019 08:50, cmflores3245

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 20:20, korireidkdotdot82021

Which of the following entries would be made to record the requisition of $12,000 of direct materials and $6,900 of indirect materials? (assume that indirect materials are included in raw materials inventory.) a. manufacturing overhead 18,900 raw materials inventory 18,900 b. wip inventory 12,000 manufacturing overhead 6,900 raw materials inventory 18,900 c. raw materials inventory 18,900 wip inventory 18,900 d. wip inventory 18,900 raw materials inventory 18,900

Answers: 1

You know the right answer?

Amachine purchased three years ago for $317,000 has a current book value using straight-line depreci...

Questions in other subjects:

English, 15.10.2020 14:01

Mathematics, 15.10.2020 14:01

Physics, 15.10.2020 14:01

English, 15.10.2020 14:01