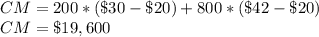

Wood carving corporation manufactures three products. because of a recent lack of skillled wood carvers, the corporation has had a shortage of available labor hours. the following per unit data relates to the three products of the corporation: letter openers elvis statues candle holderssales price $30 $80 $42variable costs $20 $40 $20labor hours required 1 6 2assume that wood carving has 1,800 labor hours available next month. also assume that wood carving can only sell 800 units of each product in a given month. what is the maximum amount of contribution margin that wood carving can generate next month given this labor hour shortage? a. $12,000b. $19,000c. $19,600 d. $19,800e. none of the above

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:30, jayjay5246

On july 1, 2016, killearn company acquired 103,000 of the outstanding shares of shaun company for $21 per share. this acquisition gave killearn a 40 percent ownership of shaun and allowed killearn to significantly influence the investee's decisions. as of july 1, 2016, the investee had assets with a book value of $6 million and liabilities of $1,468,500. at the time, shaun held equipment appraised at $140,000 above book value; it was considered to have a seven-year remaining life with no salvage value. shaun also held a copyright with a five-year remaining life on its books that was undervalued by $562,500. any remaining excess cost was attributable to goodwill. depreciation and amortization are computed using the straight-line method. killearn applies the equity method for its investment in shaun. shaun's policy is to declare and pay a $1 per share cash dividend every april 1 and october 1. shaun's income, earned evenly throughout each year, was $580,000 in 2016, $606,600 in 2017, and $649,200 in 2018. in addition, killearn sold inventory costing $93,000 to shaun for $155,000 during 2017. shaun resold $97,500 of this inventory during 2017 and the remaining $57,500 during 2018.a. determine the equity income to be recognized by killearn during each of these years. 2016 2017 2018b. compute killearn’s investment in shaun company’s balance as of december 31, 2018.

Answers: 2

Business, 22.06.2019 16:10, boogerbuttday

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 17:20, andrespeerman

States that if there is no specific employment contract saying otherwise, the employer or employee may end an employment relationship at any time, regardless of cause. rule of fair treatment due-process policy rule of law employment flexibility employment at will

Answers: 1

Business, 23.06.2019 04:50, sariyamcgregor66321

Can someone me with general journal entry on this? ?

Answers: 3

You know the right answer?

Wood carving corporation manufactures three products. because of a recent lack of skillled wood carv...

Questions in other subjects:

Mathematics, 27.10.2020 01:50

History, 27.10.2020 01:50

Mathematics, 27.10.2020 01:50

Mathematics, 27.10.2020 01:50

English, 27.10.2020 01:50

History, 27.10.2020 01:50

History, 27.10.2020 01:50

![\left[\begin{array}{cccc}\ &LO&ES&CH\\Price&30&80&42\\Cost&20&40&20\\Labor \ hours&1&6&2\\margin\ per\ hour&10&6.67&11\end{array}\right]](/tpl/images/0430/6750/a4267.png)