Business, 18.12.2019 06:31 FombafTejanjr3923

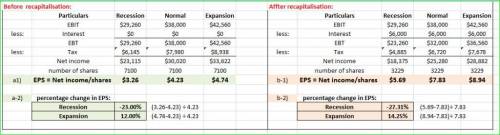

Ghost, inc., has no debt outstanding and a total market value of $220,100. earnings before interest and taxes, ebit, are projected to be $38,000 if economic conditions are normal. if there is strong expansion in the economy, then ebit will be 12 percent higher. if there is a recession, then ebit will be 23 percent lower. the company is considering a $120,000 debt issue with an interest rate of 5 percent. the proceeds will be used to repurchase shares of stock. there are currently 7,100 shares outstanding. the company has a tax rate of 21 percent, a market-to-book ratio of 1.0, and the stock price remains constant. a-1. calculate earnings per share (eps) under each of the three economic scenarios before any debt is issued. (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)a-2. calculate the percentage changes in eps when the economy expands or enters a recession. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)b-1. calculate earnings per share (eps) under each of the three economic scenarios assuming the company goes through with recapitalization. (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)b-2. given the recapitalization, calculate the percentage changes in eps when the economy expands or enters a recession. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:20, AquaNerd5706

Aproduction order quantity problem has a daily demand rate = 10 and a daily production rate = 50. the production order quantity for this problem is approximately 612 units. what is the average inventory for this problem?

Answers: 1

Business, 22.06.2019 11:10, jordanbyrd33

Robert black, regional manager for ford in texas and oklahoma, faced a dilemma. the ford f-150 pickup truck was the best-selling pickup ever, yet ford's headquarters in detroit had decided to introduce a completely redesigned f-150. how could mr. black sell both trucks at the same time? he still had "old" f-150s in stock. in his advertising, mr. black referred to the new f-150s as follows: "not a better f-150. just the only truck good enough to be the next f-150." this statement represents ford's of the new f-150.

Answers: 2

Business, 22.06.2019 11:30, kimjp56io5

Amano s preguntes cationing to come fonds and consumer good 8. why did the u. s. government use rationing for some foods and consumer goods during world war ii?

Answers: 1

You know the right answer?

Ghost, inc., has no debt outstanding and a total market value of $220,100. earnings before interest...

Questions in other subjects:

Mathematics, 06.10.2019 07:00

History, 06.10.2019 07:00

History, 06.10.2019 07:00

History, 06.10.2019 07:00

Health, 06.10.2019 07:00