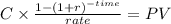

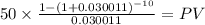

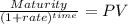

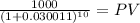

Market enterprises would like to issue $1,000 bonds and needs to determine the approximate rate it would need to pay investors. a firm with similar risk recently issued bonds with the following current features: a 5% coupon rate, 10 years until maturity, and a current price of $1,170.50. at what rate would market enterprises expect to issue bonds, assuming annual interest payments? round to the closest answer. (solve this problem using either excel's "goal seek" function, plug into tvm tables, or a financial calculator.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:50, iamhayls

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 13:40, vanessam16

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

Business, 22.06.2019 18:00, kekoanabor19

Abbington company has a manufacturing facility in brooklyn that manufactures robotic equipment for the auto industry. for year 1, abbingtonabbington collected the following information from its main production line: actual quantity purchased-200 units, actual quantity used-110 units, units standard quantity-100 units, actual price paid-$8 per unit, standard price-$10 per unit. atlantic isolates price variances at the time of purchase. what is the materials price variance for year 1? 1. $400 favorable. 2. $400 unfavorable. 3. $220 favorable. 4. $220 unfavorable.

Answers: 2

Business, 22.06.2019 23:30, SmolBeanPotato

Shelby bought her dream car, a 1966 red convertible mustang, with a loan from her credit union. if shelby paid 5.1% and the bank earned a real rate of return of 3.5%, what was the inflation rate over the life of the loan?

Answers: 2

You know the right answer?

Market enterprises would like to issue $1,000 bonds and needs to determine the approximate rate it w...

Questions in other subjects:

History, 29.10.2020 21:50

English, 29.10.2020 21:50

Chemistry, 29.10.2020 21:50

Health, 29.10.2020 21:50

Mathematics, 29.10.2020 21:50

English, 29.10.2020 21:50