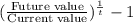

Assume a zero-coupon bond that sells for $270 and will mature in 25 years at $1,850. use appendix b for an approximate answer but calculate your final answer using the formula and financial calculator methods. what is the effective yield to maturity? (assume annual compounding. do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 19:00, mairadua14

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill.

Answers: 1

Business, 22.06.2019 21:40, QueenNerdy889

Which of the following comes after a period of recession in the business cycle? a. stagflation b. a drought c. a boom d. recovery

Answers: 1

Business, 22.06.2019 21:50, princessmoon

Labor unions have used which of the following to win passage of favorable laws such as shorter work weeks and the minimum wage? a. strikes b. collective bargaining c. lobbying d. lockouts

Answers: 1

Business, 22.06.2019 22:50, esid906

Clooney corp. establishes a petty cash fund for $225 and issues a credit card to its office manager. by the end of the month, employees made one expenditure from the petty cash fund (entertainment, $20) and three expenditures with the credit card (postage, $59; delivery, $84; supplies expense, $49).record all employee expenditures, and record the entry to replenish the petty cash fund. the credit card balance will be paid later. (if no entry is required for a transaction/event, select "no journal entry required" in the first account record expenditures from credit card and the petty cash fund.

Answers: 2

You know the right answer?

Assume a zero-coupon bond that sells for $270 and will mature in 25 years at $1,850. use appendix b...

Questions in other subjects:

Mathematics, 20.05.2021 14:00

Computers and Technology, 20.05.2021 14:00

Mathematics, 20.05.2021 14:00

Mathematics, 20.05.2021 14:00

Chemistry, 20.05.2021 14:00

Mathematics, 20.05.2021 14:00