Business, 17.12.2019 05:31 deadslinger5134

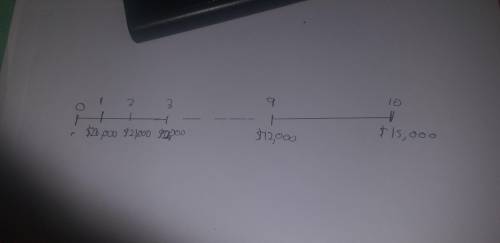

Value of a mixed stream harte systems, inc., a maker of electronic survillance equipment, is considering selling the rights to market its home security system to a well-known hardware chain. the proposed deal calls for the hardware chain to pay harte $28 comma 000 and $21 comma 000 at the end of years 1 and 2 and to make annual year-end payments of $12 comma 000 in years 3 through 9. a final payment to harte of $15 comma 000 would be due at the end of year 10. a. select the time line that represents the cash flows involved in the offer. b. if harte applies a required rate of return of 11% to them, what is the present value of this series of payments? c. a second company has offered harte an immediate one-time payment of $90 comma 000 for the rights to market the home security system. which offer should harte accept?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:00, josiesolomonn1605

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 01:00, pizarroisaid

An investment counselor calls with a hot stock tip. he believes that if the economy remains strong, the investment will result in a profit of $40 comma 00040,000. if the economy grows at a moderate pace, the investment will result in a profit of $10 comma 00010,000. however, if the economy goes into recession, the investment will result in a loss of $40 comma 00040,000. you contact an economist who believes there is a 2020% probability the economy will remain strong, a 7070% probability the economy will grow at a moderate pace, and a 1010% probability the economy will slip into recession. what is the expected profit from this investment?

Answers: 2

Business, 22.06.2019 11:00, montgomerykarloxc24x

You decide to invest in a portfolio consisting of 25 percent stock a, 25 percent stock b, and the remainder in stock c. based on the following information, what is the expected return of your portfolio? state of economy probability of state return if state occurs of economy stock a stock b stock c recession .16 - 16.4 % - 2.7 % - 21.6 % normal .55 12.6 % 7.3 % 15.9 % boom .29 26.2 % 14.6 % 30.5 %

Answers: 1

Business, 22.06.2019 13:50, veronica25681

When used-car dealers signal the quality of a used car with a warranty, a. buyers believe the signal because the cost of a false signal is high b. it is not rational to believe the signal because some used-car dealers are crooked c. the demand for lemons is eliminated d. the price of a lemon rises above the price of a good used car because warranty costs on lemons are greater than warranty costs on good used cars

Answers: 2

You know the right answer?

Value of a mixed stream harte systems, inc., a maker of electronic survillance equipment, is conside...

Questions in other subjects:

History, 06.10.2019 06:30

Mathematics, 06.10.2019 06:30