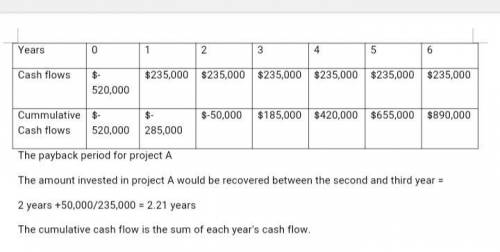

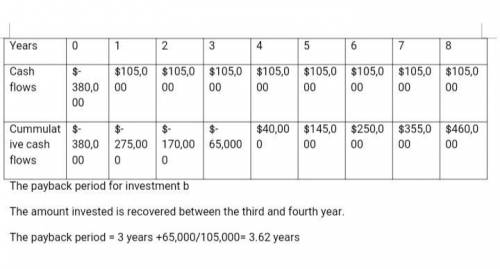

Compute the payback period for each of these two separate investments (round the payback period to two decimals): a. a new operating system for an existing machine is expected to cost $520,000 and have a useful life of six years. the system yields an incremental after-tax income of $150,000 each year after deducting its straight-line depreciation. the predicted salvage value of the system is $10,000.b. a machine costs $380,000, has a $20,000 salvage value, is expected to last eight years, and will generate an after-tax income of $60,000 per year after straight-line depreciation. nb: i need a detailed and well explained answer. full points would be awarded for a detailed and well explained answer

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 10:30, natajaeecarr

Jack manufacturing company had beginning work in process inventory of $8,000. during the period, jack transferred $34,000 of raw materials to work in process. labor costs amounted to $41,000 and overhead amounted to $36,000. if the ending balance in work in process inventory was $12,000, what was the amount transferred to finished goods inventory?

Answers: 2

Business, 22.06.2019 20:00, princesincer9256

The master manufacturing company has just announced a tender offer for its own common stock. master is offering to buy up to 100% of the company's stock at $20 per share contingent on at least 64% of the outstanding shares being tendered. after the announcement of the offer, the stock closed on the nyse up 2.50 at $18.75. a customer has 100 shares of master stock in his cash account. the customer tells you that he wishes to "cash out" his position. you should recommend that the customer:

Answers: 2

Business, 22.06.2019 20:10, hsbhxsb

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

Business, 23.06.2019 00:00, destinyranson

Which of the following is not a factor to consider when deciding whether to accept a special order? whether this order will hurt the brand name of the company whether other potential orders would be more profitable whether additional fixed costs would need to be incurred whether the offered price is sufficient to cover prime costs and fixed overhead allocated all of the above

Answers: 2

You know the right answer?

Compute the payback period for each of these two separate investments (round the payback period to t...

Questions in other subjects:

Mathematics, 10.06.2020 21:57