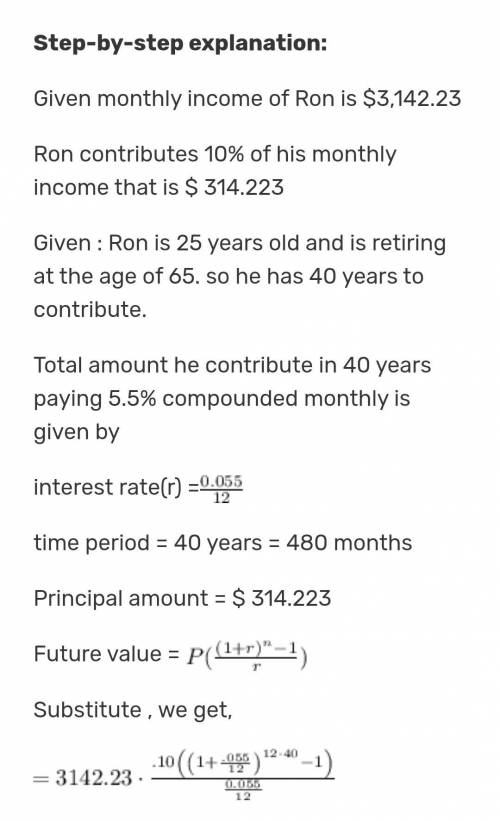

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income of $4,123 for 20 years. if ron contributes 10% of his monthly income to a 401(k) paying 5.5% compounded monthly, will he reach his goal for retirement given that his monthly income is 3,142.23? if he does not make his goal then state by what amount he will need to supplement his income. round all answers to the nearest cent. a.ron will meet his monthly goal of exactly $4,123 for retirement. b.ron will meet his monthly goal of $4,123 for retirement with an excess of $125.34.c. ron will not make his monthly goal of $4,123 and will need $359.74 to supplement his monthly income when he retires. d.ron will not make his monthly goal of $4,123 and will need $450.61 to supplement his monthly income when he retires.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:10, Emmaxox715

Yowell company granted a sales discount of $360 to a customer when it collected the amount due on account. yowell uses the perpetual inventory system. which of the following answers reflects the effects on the financial statements of only the discount? assets = liab. + equity rev. − exp. = net inc. cash flow a. (360 ) = na + (360 ) (360 ) − na = (360 ) (360 ) oa b. na = (360 ) + 360 360 − na = 360 na c. (360 ) = na + (360 ) (360 ) − na = (360 ) na d. na = (360 ) + 360 360 − na = 360 na

Answers: 1

Business, 22.06.2019 17:00, ocean11618

Oliver is the vice president of production at his company and has been managing the launch of new software systems. he worked with a team of individuals who were tasked to create awareness about a specific product and also to approach potential purchasers of the product. which department managers were part of oliver’s team?

Answers: 3

Business, 22.06.2019 23:10, 401666

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

You know the right answer?

Ron is 25 years old and is retiring at the age of 65. when he retires, he will need a monthly income...

Questions in other subjects:

Mathematics, 19.11.2019 13:31

Mathematics, 19.11.2019 13:31

Mathematics, 19.11.2019 13:31

Mathematics, 19.11.2019 13:31

Mathematics, 19.11.2019 13:31