Business, 14.12.2019 02:31 ryleepretty

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target capital structure. currently it targets a 50-50 mix of debt and equity, but it is considering a target capital structure with 70% debt. american exploration currently has 6% after-tax cost of debt and a 12% cost of common stock. the company does not have any preferred stock outstanding.

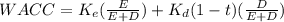

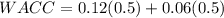

a. what is american exploration's current wacc?

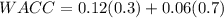

b. assuming that its cost of debt and equity remain unchanged, what will be american exploration's wacc under the revised target capital structure?

c. do you think shareholders are affected by the increase in debt to 70%? if so, how are they affected? are the common stock claims riskier now?

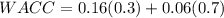

d. suppose that in response to the increase in debt, american exploration's shareholders increase their required return so that cost of common equity is 16%. what will its new wacc be in this case?

e. what does your answer in part d suggest about the tradeoff between financing with debt versus equity?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:30, kkpsmith

Required information [the following information applies to the questions displayed below.] the following data is provided for garcon company and pepper company. garcon company pepper company beginning finished goods inventory $ 13,800 $ 18,850 beginning work in process inventory 16,700 20,700 beginning raw materials inventory 8,800 13,500 rental cost on factory equipment 28,250 26,650 direct labor 22,400 37,400 ending finished goods inventory 17,300 14,300 ending work in process inventory 23,200 19,400 ending raw materials inventory 5,900 9,600 factory utilities 11,250 15,000 factory supplies used 10,900 5,700 general and administrative expenses 32,500 44,500 indirect labor 2,500 9,880 repairs—factory equipment 4,820 2,150 raw materials purchases 41,500 63,000 selling expenses 54,800 49,000 sales 238,530 317,510 cash 33,000 23,700 factory equipment, net 222,500 124,825 accounts receivable, net 13,400 23,950 required: 1. complete the table to find the cost of goods manufactured for both garcon company and pepper company for the year ended december 31, 2017. 2. complete the table to calculate the cost of goods sold for both garcon company and pepper company for the year ended december 31, 2017.

Answers: 2

Business, 22.06.2019 04:30, awdadaddda

Galwaysc electronics makes two products. model a requires component a and component c. model b requires component b and component c. new versions of both models are released each year with updated versions of all components. all components are sourced overseas, and abc contracts annually for a quantity of each component before seeing that year’s demand. components are only assembled into finished products once demand for each model is known. for the coming year, alwaysc’s purchasing manner has proposed ordering 500,000 units of component a, 630,000 of component b, and 1,000,000 units of component c. her boss has asked why she has recommended purchasing so much of components a and b when alwaysc will not have enough of component c to fully use all of the inventory of a and b. what factors might the purchasing manager cite to explain her recommended order? explain your reasoning.

Answers: 3

Business, 22.06.2019 13:30, drippyc334

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 14:00, tamariarodrigiez

How many months does the federal budget usually take to prepare

Answers: 1

You know the right answer?

American exploration, inc., a natural gas producer, is trying to decide whether to revise its target...

Questions in other subjects:

English, 25.01.2022 02:50

Mathematics, 25.01.2022 02:50

Mathematics, 25.01.2022 02:50

Mathematics, 25.01.2022 02:50

Mathematics, 25.01.2022 02:50

English, 25.01.2022 02:50