Business, 14.12.2019 02:31 sadiesnider9

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of manufacturing 23,600 golf discs is: materials $ 12,744 labor 36,344 variable overhead 24,308 fixed overhead 48,144 total $121,540 bonita also incurs 7% sales commission ($0.49) on each disc sold. mcgee corporation offers gruden $4.90 per disc for 5,100 discs. mcgee would sell the discs under its own brand name in foreign markets not yet served by bonita. if bonita accepts the offer, its fixed overhead will increase from $48,144 to $52,714 due to the purchase of a new imprinting machine. no sales commission will result from the special order.

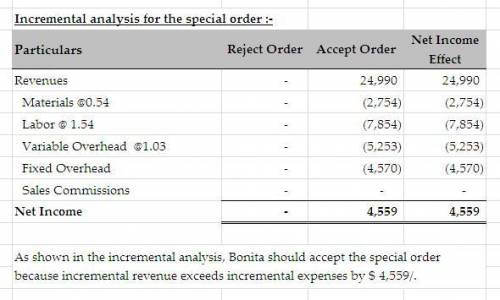

(a) prepare an incremental analysis for the special order. (enter negative amounts using either a negative sign preceding the number e. g. -45 or parentheses e. g. ( reject order accept order net income increase (decrease) revenues $ $ $ materials labor variable overhead fixed overhead sales commissions net income $ $ $

(b) should bonita accept the special order? bonita should the special order .

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:30, baseball1525

Why does the united states government provide tax breaks related to the amount of money companies spend on research and development? a. to provide incentives for companies to conduct research and development to allow antitrust authorities b. to challenge joint research efforts c. to protect the right of inventors d. to produce and sell their inventions e. to involve less government scrutiny than a government funded project

Answers: 1

Business, 22.06.2019 13:10, legendman27

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows. direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow. fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

Business, 22.06.2019 16:20, Zshotgun33

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Business, 22.06.2019 16:40, yoooo9313

An electronics store is running a promotion where for every video game purchased, the customer receives a coupon upon checkout to purchase a second game at a 50% discount. the coupons expire in one year. the store normally recognized a gross profit margin of 40% of the selling price on video games. how would the store account for a purchase using the discount coupon?

Answers: 3

You know the right answer?

Bonita company produces golf discs which it normally sells to retailers for $7 each. the cost of man...

Questions in other subjects:

English, 26.05.2021 17:30

History, 26.05.2021 17:30

English, 26.05.2021 17:30

Mathematics, 26.05.2021 17:30

Arts, 26.05.2021 17:30

Mathematics, 26.05.2021 17:30

Mathematics, 26.05.2021 17:30

Biology, 26.05.2021 17:30

Social Studies, 26.05.2021 17:30