Business, 11.12.2019 06:31 glyptictriton9575

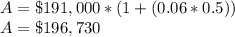

On november 1, 2021, new morning bakery signed a $191,000, 6%, six-month note payable with the amount borrowed plus accrued interest due sik months later on may 1, 2022 new morning bakery records the appropriate adjusting entry for the note on december 31, 2021. what amount of cash will be needed to pay back the note payable plus any accrued interest on may 1, 2022? (do not round your intermediate calculations.) ebook multiple choice $195,775. $196,730. $191,955 $191,000

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 16:40, michibabiee

Shawn received an e-mail offering a great deal on music, movie, and game downloads. he has never heard of the company, and the e-mail address and company name do not match. what should shawn do?

Answers: 2

Business, 22.06.2019 19:20, kingo7

After jeff bezos read about how the internet was growing by 2,000 percent a month, he set out to use the internet as a new distribution channel and founded amazon, which is now the world's largest online retailer. this is clearly an example of a(n)a. firm that uses closed innovation. b. entrepreneur who commercialized invention into an innovation. c. business that entered the industry during its maturity stage. d. exception to the long tail business model

Answers: 1

You know the right answer?

On november 1, 2021, new morning bakery signed a $191,000, 6%, six-month note payable with the amoun...

Questions in other subjects:

Social Studies, 02.09.2019 13:30

Mathematics, 02.09.2019 13:30

Biology, 02.09.2019 13:30

Chemistry, 02.09.2019 13:30

History, 02.09.2019 13:30