Business, 10.12.2019 04:31 amberskids2

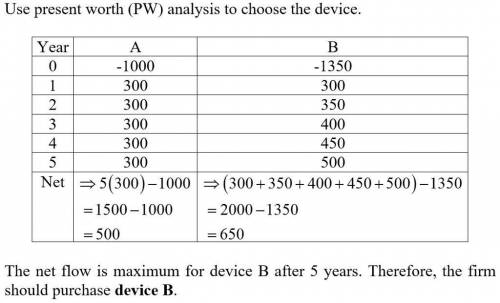

Afirm is trying to decide which of two devices to install to reduce costs in a particular situation devices a costs $1000, device b costs $1350 and both have useful lives of 5 years and no salvage value device a can be expected to result in $300 savings annually device b will provide cost savings of $300 the first year, but savings will increase by $50 annually, making the second-year savings $350, the third-year savings $400, and so forth with interest rate at 7%, which device should the firm purchase? use cost benefit ratio to solve this question. show all your steps, build models, provide them with number, come up with results and show their units, then, draw conclusions.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 07:40, sistersquad

Myflvs -question 3 multiple choice worth 2 points)(10.04 hc)in panama city in january, high tide was at midnight. the water level at high tide was 9 feet and1 foot at low tide. assuming the next high tide is exactly 12 hours later and that the height of thewater can be modeled by a cosine curve, find an equation for water level in january for panamacity as a function of time (t).of(t) = 4 + 5of(t) = 5 cost + 4o 460) = 5 cos 1+ 4of(0) = 4 cos + 5

Answers: 1

Business, 22.06.2019 12:30, chycooper101

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 15:20, byler47

Capital financial corporation will lend 90 percent against account balances that have averaged 30 days or less; 80 percent for account balances between 31 and 40 days; and 70 percent for account balances between 41 and 45 days. customers that take over 45 days to pay their bills are not considered acceptable accounts for a loan. the current prime rate is 16.50 percent, and capital charges 3.50 percent over prime to charming as its annual loan rate. a. determine the maximum loan for which charming paper company could qualify.

Answers: 1

You know the right answer?

Afirm is trying to decide which of two devices to install to reduce costs in a particular situation...

Questions in other subjects:

Chemistry, 04.03.2021 01:00

Biology, 04.03.2021 01:00

Chemistry, 04.03.2021 01:00

Mathematics, 04.03.2021 01:00

English, 04.03.2021 01:00