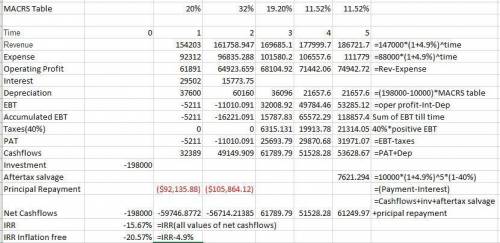

Afirm is considering purchasing a computer system.-cost of system is $198,000. the firm will pay for the computer system in year 0.-project life: 5 years-salvage value in year 0 (constant) dollars: $10,000-depreciation method: five-years macrs-marginal income-tax rate = 40% (remains constant over time)-annual revenue = $147,000 (year-0 constant dollars)-annual expenses (not including depreciation) = $88,000 (year-0 constant dollars)-the general inflation rate is 4.9% during the project period (which will affect all revenues, expenses, and the salvage value but not firm borrows the entire $198,000 at 14.9% interest to be repaid in 2 annual payments. the debt interest paid and the principal payment should not be changed by the inflation rate. lending agencies set the interest rate of borrowing to account for the inflation rate. calculate the effects of borrowing and include the debt interest paid and the principal repayment into the income statement and cash flow statement. determine the inflation-free irr' of the computer system. enter your answer as a percentage between 0 and 100."

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:20, Becky81

Which of the following statements concerning an organization's strategy is true? a. cost accountants formulate strategy in an organization since they have more inputs about costs. b. businesses usually follow one of two broad strategies: offering a quality product at a high price, or offering a unique product or service priced lower than the competition. c. a good strategy will always overcome poor implementation. d. strategy specifies how an organization matches its own capabilities with the opportunities in the marketplace to accomplish its objectives.

Answers: 1

Business, 22.06.2019 05:30, 2023greenlanden

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 12:50, laxraAragon

Jallouk corporation has two different bonds currently outstanding. bond m has a face value of $50,000 and matures in 20 years. the bond makes no payments for the first six years, then pays $2,100 every six months over the subsequent eight years, and finally pays $2,400 every six months over the last six years. bond n also has a face value of $50,000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. the required return on both these bonds is 10 percent compounded semiannually. what is the current price of bond m and bond n?

Answers: 3

Business, 22.06.2019 19:50, alexdziob01

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

You know the right answer?

Afirm is considering purchasing a computer system.-cost of system is $198,000. the firm will pay for...

Questions in other subjects:

Mathematics, 09.06.2020 17:57

Mathematics, 09.06.2020 17:57