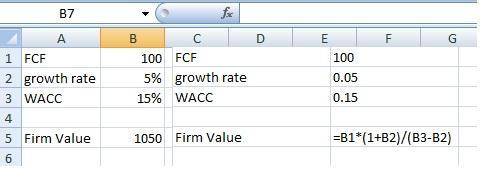

Young & liu inc.'s free cash flow during the just-ended year (t = 0) was $100 million, and fcf is expected to grow at a constant rate of 5% in the future. if the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? i have came up with an answer of 1.050m, but because i am not good with excel i am not sure n how to enter this as a formula, show detail information. i kep gatting "value" error. if t can be done, if not i will just leave it as is. you in advance.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 12:00, kaylallangari549

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

Business, 22.06.2019 19:00, chloesmolinski0909

Why is accountability important in managing safety

Answers: 2

Business, 22.06.2019 21:30, angoliabirtio

The adjusted trial balance for china tea company at december 31, 2018, is presented below:

Answers: 1

Business, 22.06.2019 23:50, yatayjenings12

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

You know the right answer?

Young & liu inc.'s free cash flow during the just-ended year (t = 0) was $100 million, and fcf...

Questions in other subjects:

Social Studies, 26.03.2021 21:50

Mathematics, 26.03.2021 21:50

Mathematics, 26.03.2021 21:50

Computers and Technology, 26.03.2021 21:50

Social Studies, 26.03.2021 21:50

Social Studies, 26.03.2021 21:50