Business, 03.12.2019 04:31 malissa0325

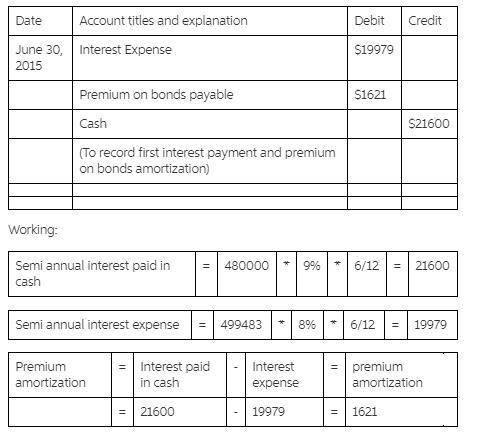

On january 1, 2015, stronger industries issued $480,000 of 9%, five-year bonds that pay interest semiannually on june 30 and december 31. they are issued at $499,483 and their market rate is 8% at the issue date. after recording the entry for the issuance of the bonds, bonds payable had a balance of $480,000 and premium on bonds payable had a balance of $19,483. stroger uses the effective interest bond amortization method. the first semiannual interest payment was made on june 30, 2015. complete the necessary journal entry for the interest payment date of june 30, 2015 by selecting the account names an dollar amounts from the drop-down menus.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:20, williampagan9532

Which of the following statements is true? a. financial investment refers to the creation and expansion of business enterprisesb. economic investment refers to the creation and expansion of business enterprisesc. economic investment refers to the purchase of assets such as stocks, bonds, and real estated. both economic and financial investment refer to the purchase of assets such as stocks, bonds, and real estate

Answers: 2

Business, 21.06.2019 22:30, weeblordd

Chip wilson has hired goldman sachs, an investment banking company, to assist him with a hostile takeover of lululemon. wilson's goal is to hire a new board of directors because he believes there is a need for a more long-term focus. goldman sachs is a proven firm at making a profit in every move that they make. if the hostile takeover does not pan out, what could be another motive for investors?

Answers: 1

Business, 22.06.2019 00:30, kierafisher05

You wants to open a saving account. which account will grow his money the most

Answers: 1

Business, 22.06.2019 04:00, neariah24

Assume that the following conditions exist: a. all banks are fully loaned up- there are no excess reserves, and desired excess reserves are always zero. b. the money multiplier is 5 . c. the planned investment schedule is such that at a 4 percent rate of interest, investment =$1450 billion. at 5 percent, investment is $1420 billion. d. the investment multiplier is 3 . e.. the initial equilibrium level of real gdp is $12 trillion. f. the equilibrium rate of interest is 4 percent now the fed engages in contractionary monetary policy. it sells $1 billion worth of bonds, which reduces the money supply, which in turn raises the market rate of interest by 1 percentage point. calculate the decrease in money supply after fed's sale of bonds: $nothing billion.

Answers: 2

You know the right answer?

On january 1, 2015, stronger industries issued $480,000 of 9%, five-year bonds that pay interest sem...

Questions in other subjects:

English, 01.04.2021 14:00

Mathematics, 01.04.2021 14:00

History, 01.04.2021 14:00

English, 01.04.2021 14:00

Mathematics, 01.04.2021 14:00

English, 01.04.2021 14:00