Business, 30.11.2019 02:31 jarvinmcgillp3dhni

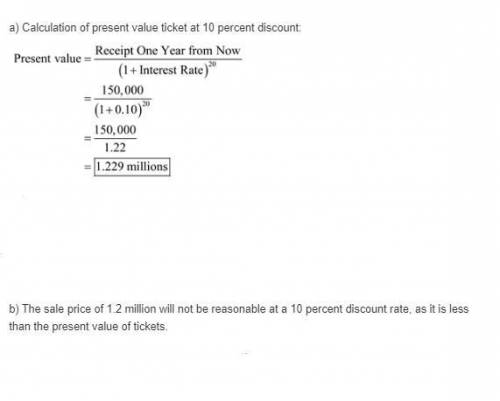

According to a news item, the owner of a lottery ticket paying $3 million over 20 years is offering to sell the ticket for $1.2 million cash now. "who knows? " the ticket owner explained. "we might not even be here in 20 years, and i do not want to leave it to the dinosaurs." suppose the ticket pays $150,000 per year at the end of each year for the next 20 years, and the appropriate rate for discounting the future income is thought to be 15% the present value of the ticket is approximately true or false: if the discount rate is in the 15% range, the sale price of $948,289 is reasonable (within 10% of the present value of the ticket). true false

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:30, josehernamdez3035

Ben collins plans to buy a house for $166,000. if the real estate in his area is expected to increase in value by 2 percent each year, what will its approximate value be five years from now?

Answers: 1

Business, 22.06.2019 12:20, mxrvin4977

In terms of precent, beer has more alcohol than whiskey true or false

Answers: 1

Business, 22.06.2019 22:10, Har13526574

jackie's snacks sells fudge, caramels, and popcorn. it sold 12,000 units last year. popcorn outsold fudge by a margin of 2 to 1. sales of caramels were the same as sales of popcorn. fixed costs for jackie's snacks are $14,000. additional information follows: product unit sales prices unit variable cost fudge $5.00 $4.00 caramels $8.00 $5.00 popcorn $6.00 $4.50 the breakeven sales volume in units for jackie's snacks is

Answers: 1

You know the right answer?

According to a news item, the owner of a lottery ticket paying $3 million over 20 years is offering...

Questions in other subjects:

Mathematics, 24.06.2019 00:00

Mathematics, 24.06.2019 00:00

Mathematics, 24.06.2019 00:00

English, 24.06.2019 00:00

Mathematics, 24.06.2019 00:00