Business, 30.11.2019 02:31 karenlemus4774

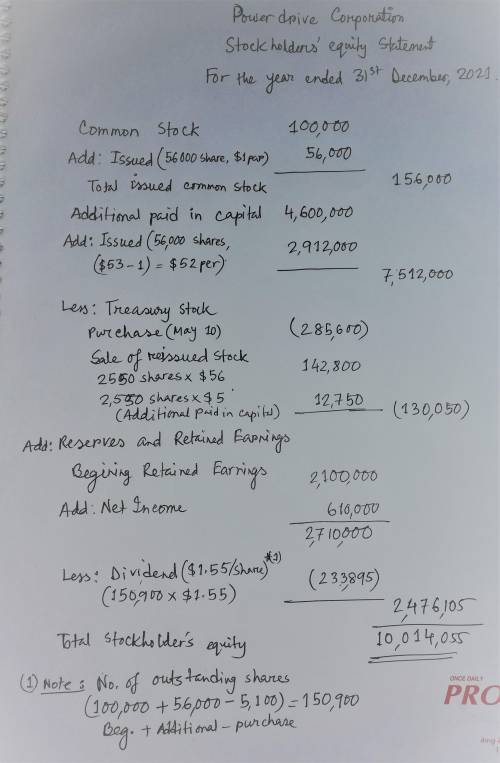

Power drive corporation designs and produces a line of golf equipment and golf apparel. power drive has 100,000 shares of common stock outstanding as of the beginning of 2021. power drive has the following transactions affecting stockholders' equity in 2021. march 1 issues 56,000 additional shares of $1 par value common stock for $53 per share. may 10 purchases 5,100 shares of treasury stock for $56 per share. june 1 declares a cash dividend of $1.55 per share to all stockholders of record on june 15. (hint: dividends are not paid on treasury stock.) july 1 pays the cash dividend declared on june 1. october 21 resells 2,550 shares of treasury stock purchased on may 10 for $61 per share. power drive corporation has the following beginning balances in its stockholders' equity accounts on january 1, 2021: common stock, $100,000; additional paid-in capital, $4,600,000; and retained earnings, $2,100,000. net income for the year ended december 31, 2021, is $610,000. required: prepare the stockholders' equity section of the balance sheet for power drive corporation as of december 31, 2021.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:00, gracye

Kenney co. uses process costing to account for the production of canned energy drinks. direct materials are added at the beginning of the process and conversion costs are incurred uniformly throughout the process. equivalent units have been calculated to be 19,200 units for materials and 16,000 units for conversion costs. beginning inventory consisted of $11,200 in materials and $6,400 in conversion costs. april costs were $57,600 for materials and $64,000 for conversion costs. ending inventory still in process was 6,400 units (100% complete for materials, 50% for conversion). the total cost per unit using the weighted average method would be closest to:

Answers: 2

Business, 22.06.2019 23:30, hehefjf3854

Miller company’s total sales are $171,000. the company’s direct labor cost is $20,520, which represents 30% of its total conversion cost and 40% of its total prime cost. its total selling and administrative expense is $25,650 and its only variable selling and administrative expense is a sales commission of 5% of sales. the company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. required: 1. what is the total manufacturing overhead cost? 2. what is the total direct materials cost? 3. what is the total manufacturing cost? 4. what is the total variable selling and administrative cost? 5. what is the total variable cost? 6. what is the total fixed cost? 7. what is the total contribution margin?

Answers: 3

Business, 23.06.2019 00:30, Nerdylearner8639

Kim davis is in the 40 percent personal tax bracket. she is considering investing in hca(taxable) bonds that carry a 12 percent interest rate. what is her after- tax yield(interest rate) on the bonds?

Answers: 1

You know the right answer?

Power drive corporation designs and produces a line of golf equipment and golf apparel. power drive...

Questions in other subjects:

Mathematics, 16.09.2020 22:01

Biology, 16.09.2020 22:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Chemistry, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01

Mathematics, 16.09.2020 23:01