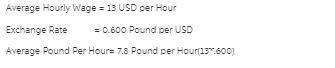

Assume that general electric is trying to decide whether to locate a new production facility in the united states or in israel. in order to make its decision, the company wants to compare labor costs in the two countries. the average hourly wage in the united states is approximately $ 18 per hour. the u. s. exchange rate with israel is 3.40 shekel per dollar. convert the average u. s. hourly wage into units of shekel per hour.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:00, ummsumaiyah3583

Balance sheet the assets of dallas & associates consist entirely of current assets and net plant and equipment. the firm has total assets of $2 5 million and net plant and equipment equals $2 million. it has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1 5 million. the firm does have accounts payable and accruals on its balance sheet. the firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. a. what is the company's total debt? b. what is the amount of total liabilities and equity that appears on the firm's balance sheet? c. what is the balance of current assets on the firm's balance sheet? d. what is the balance of current liabilities on the firm's balance sheet? e. what is the amount of accounts payable and accruals on its balance sheet? [hint: consider this as a single line item on the firm's balance sheet.] f. what is the firm's net working capital? g. what is the firm's net operating working capital? h. what is the explanation for the difference in your answers to parts f and g?

Answers: 1

Business, 22.06.2019 02:00, bryceisabeast6206

Benton company (bc), a calendar year entity, has one owner, who is in the 37% federal income tax bracket (any net capital gains or dividends would be taxed at a 20% rate). bc's gross income is $395,000, and its ordinary trade or business deductions are $245,000. ignore the standard deduction (or itemized deductions) and the deduction for qualified business income. if required, round computations to the nearest dollar. a. bc is operated as a proprietorship, and the owner withdraws $100,000 for personal use. bc's taxable income for the current year is $ , and the tax liability associated with the income from the sole proprietorship is $ . b. bc is operated as a c corporation, pays out $100,000 as salary, and pays no dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . the shareholder's tax liability is $ . c. bc is operated as a c corporation and pays out no salary or dividends to its shareholder. bc's taxable income for the current year is $ , and bc's tax liability is $ . d. bc is operated as a c corporation, pays out $100,000 as salary, and pays out the remainder of its earnings as dividends. bc's taxable income for the current year is $ , and bc's tax liability is $ .

Answers: 2

Business, 22.06.2019 02:20, lovehelping1564

Neon light company of kansas city ships lamps and lighting appliances throughout the country. ms. neon has determined that through the establishment of local collection centers around the country, she can speed up the collection of payments by one and one-half days. furthermore, the cash management department of her bank has indicated to her that she can defer her payments on her accounts by one-half day without affecting suppliers. the bank has a remote disbursement center in florida. a. if neon light company has $2.90 million per day in collections and $1.18 million per day in disbursements, how many dollars will the cash management system free up?

Answers: 2

You know the right answer?

Assume that general electric is trying to decide whether to locate a new production facility in the...

Questions in other subjects:

Mathematics, 02.03.2021 21:30

Mathematics, 02.03.2021 21:30

Physics, 02.03.2021 21:30

English, 02.03.2021 21:30

History, 02.03.2021 21:30

Mathematics, 02.03.2021 21:30