Business, 28.11.2019 05:31 Joxnny8757

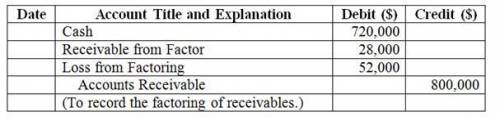

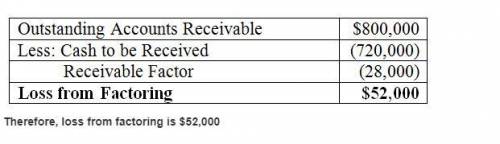

Samson wholesale beverage company regularly factors its accounts receivable with the milpitas finance company. on april 30, 2018, the company transferred $800,000 of accounts receivable to milpitas. the transfer was made without recourse. milpitas remits 90% of the factored amount and retains 10%. when milpitas collects the receivables, it remits to samson the retained amount less a 4% fee (4% of the total factored amount). samson estimates the fair value of the last 10% of its receivables to be $60,000.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 16:30, emmmssss21

Bernard made a gift of $500,000 to his brother in 2014. due to bernard’s prior taxable gifts he paid $200,000 of gift tax. when bernard died in 2019, the applicable gift tax credit had increased. at bernard’s death, what amount related to the $500,000 gift to his brother is included in his gross estate?

Answers: 3

Business, 22.06.2019 19:00, chrisroman152

20. to add body to a hearty broth, you may use a. onions. b. pasta. c. cheese. d. water.

Answers: 2

Business, 22.06.2019 21:30, dondre54

The year-end financial statements of calloway company contained the following elements and corresponding amounts: assets = $34,000; liabilities = ? ; common stock = $6,400; revenue = $13,800; dividends = $1,450; beginning retained earnings = $4,450; ending retained earnings = $8,400. based on this information, the amount of expenses on calloway's income statement was

Answers: 1

Business, 22.06.2019 23:00, terrickaimani

Investors who put their own money into a startup are known as a. mannequins b. obligators c. angels d. borrowers

Answers: 1

You know the right answer?

Samson wholesale beverage company regularly factors its accounts receivable with the milpitas financ...

Questions in other subjects:

Social Studies, 23.12.2020 01:00

History, 23.12.2020 01:00

Mathematics, 23.12.2020 01:00

History, 23.12.2020 01:00

Mathematics, 23.12.2020 01:00

English, 23.12.2020 01:00