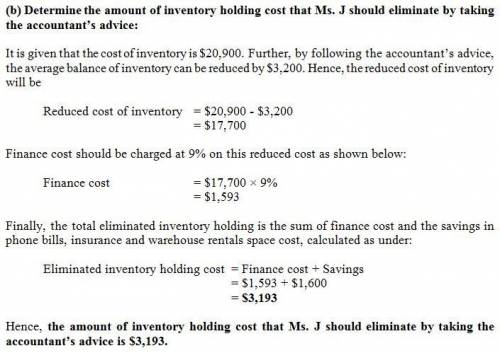

Rundle pet supplies purchases its inventory from a variety of suppliers, some of which require a six-week lead time before delivering the goods. to ensure that she has a sufficient supply of goods on hand, ms. leblanc, the owner, must maintain a large supply of inventory. the cost of this inventory averages $21,500. she usually finances the purchase of inventory and pays a 10 percent annual finance charge. ms. leblanc’s accountant has suggested that she establish a relationship with a single large distributor who can satisfy all of her orders within a two-week time period. given this quick turnaround time, she will be able to reduce her average inventory balance to $3,400. ms. leblanc also believes that she could save $2,500 per year by reducing phone bills, insurance, and warehouse rental space costs associated with ordering and maintaining the larger level of inventory. required based on the information provided, how much of ms. leblanc’s inventory holding cost could be eliminated by taking the accountant’s advice?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, gavinarcheroz2jxq

Consider the following limit order book for a share of stock. the last trade in the stock occurred at a price of $50. limit buy orders limit sell orders price shares price shares $49.75 500 $49.80 100 49.70 900 49.85 100 49.65 700 49.90 300 49.60 400 49.95 100 48.65 600 a. if a market buy order for 100 shares comes in, at what price will it be filled? (round your answer to 2 decimal places.) b. at what price would the next market buy order be filled? (round your answer to 2 decimal places.) c. if you were a security dealer, would you want to increase or decrease your inventory of this stock? increase decrease

Answers: 2

Business, 22.06.2019 05:10, russboys3

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 19:00, mairadua14

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill.

Answers: 1

Business, 22.06.2019 20:30, Picklehead1166

Data for hermann corporation are shown below: per unit percent of sales selling price $ 125 100 % variable expenses 80 64 contribution margin $ 45 36 % fixed expenses are $85,000 per month and the company is selling 2,700 units per month. required: 1-a. how much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,000 and monthly sales increase by $20,000? 1-b. should the advertising budget be increased?

Answers: 1

You know the right answer?

Rundle pet supplies purchases its inventory from a variety of suppliers, some of which require a six...

Questions in other subjects:

Mathematics, 18.02.2021 19:10

Mathematics, 18.02.2021 19:10

Mathematics, 18.02.2021 19:10