Business, 27.11.2019 03:31 KhaliylTestman

Standard olive company of california has a $1,000 par value convertible bond outstanding with a coupon rate of 8 percent and a maturity date of 20 years. it is rated aa, and competitive, nonconvertible bonds of the same risk class carry a 18 percent yield. the conversion ratio is 30. currently the common stock is selling for $30 per share on the new york stock exchange.

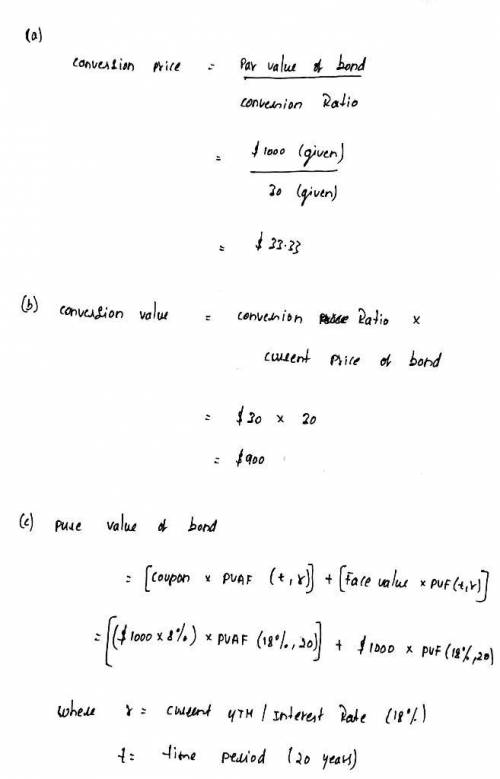

a. what is the conversion price? (round your answer to 2 decimal places.)

b. what is the conversion value? (round your answer to 2 decimal places.)

c. compute the pure bond value. (use semiannual analysis.) use appendix b and appendix d as an approximate answer, but calculate your final answer using the formula and financial calculator methods. (do not round intermediate calculations. round your final answer to 2 decimal places.)

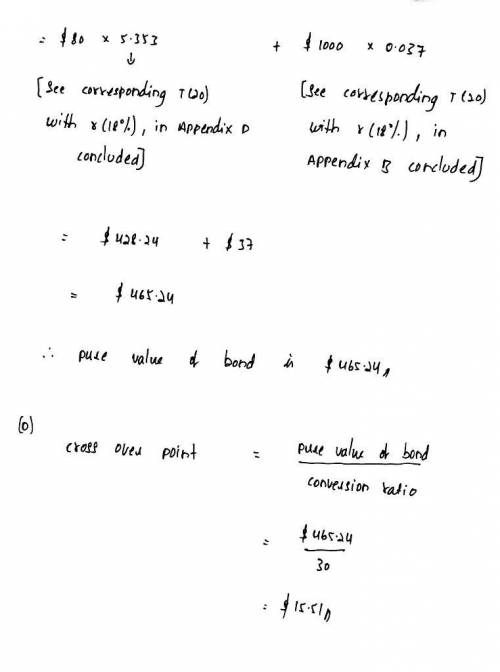

d. calculate the crossover point at which the pure bond value equals conversion value. (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 05:30, 2023greenlanden

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 23:00, brok3morgan

The quinoa seed is in high demand in wealthier countries such as the u. s. and japan. approximately 97% of all quinoa production comes from small farmers in bolivia and peru who farm at high elevations—8,000 feet or higher. the seed is considered highly nutritious. mostly grown and harvested in bolivia and peru, and sold to markets in other countries, the seed is now considered an important for these nations. the governments of bolivia and peru are hopeful that this product will increase the quality of life of their farmers.

Answers: 3

Business, 23.06.2019 03:20, Wolfgirl2032

Suppose that fixed costs for a firm in the automobile industry (start-up costs of factories, capital equipment, and so on) are $5 billion and that variable costs are equal to $17,000 per finished automobile. because more firms increase competition in the market, the market price falls as more firms enter an automobile market, or specifically, , where n represents the number of firms in a market. assume that the initial size of the u. s. and the european automobile markets are 300 million and 533 million people, respectively. a. calculate the equilibrium number of firms in the u. s. and european automobile markets without trade. b. what is the equilibrium price of automobiles in the united states and europe if the automobile industry is closed to foreign trade? c. now suppose that the united states decides on free trade in automobiles with europe. the trade agreement with the europeans adds 533 million consumers to the automobile market, in addition to the 300 million in the united states. how many automobile firms will there be in the united states and europe combined? what will be the new equilibrium price of automobiles? d. why are prices in the united states different in (c) and (b)? are consumers better off with free trade? in what ways?

Answers: 1

Business, 23.06.2019 07:50, catherineguyen3216

Suppose that two countries, britain and the u. s. produce just one good - beef. suppose that the price of beef in the u. s. is $2.80 per pound, and in britain it is £3.70 per pound. according to ppp theory, what should the $/£ spot exchange rate be? suppose the price of beef is expected to rise to $3.10 in the u. s. and to £4.65 in britain. what should be the one year forward $/£ exchange rate?

Answers: 1

You know the right answer?

Standard olive company of california has a $1,000 par value convertible bond outstanding with a coup...

Questions in other subjects:

Mathematics, 26.03.2020 12:14

Arts, 26.03.2020 12:14

History, 26.03.2020 12:15

Mathematics, 26.03.2020 12:15

Mathematics, 26.03.2020 12:16

Mathematics, 26.03.2020 12:16

Health, 26.03.2020 12:16