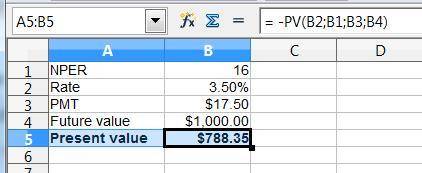

Bsw corporation has a bond issue outstanding with an annual coupon rate of 7 percent paid quarterly and four years remaining until maturity. the par value of the bond is $1,000. determine the fair present value of the bond if market conditions justify a 14 percent, compounded quarterly, required rate of return. (do not round intermediate calculations. round your answer to 2 decimal places. (e. g., 32.16))

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:30, missheyward30

What is the relationship among market segmentation, target markts, and consumer profiles?

Answers: 2

Business, 22.06.2019 20:00, LJ710

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

Business, 22.06.2019 20:40, IkweWolf1824

Which of the following would indicate an improvement in a company's financial position, holding other things constant? a. the inventory and total assets turnover ratios both decline. b. the debt ratio increases. c. the profit margin declines. d. the times-interest-earned ratio declines. e. the current and quick ratios both increase.

Answers: 3

You know the right answer?

Bsw corporation has a bond issue outstanding with an annual coupon rate of 7 percent paid quarterly...

Questions in other subjects:

English, 27.08.2019 21:30

History, 27.08.2019 21:30

History, 27.08.2019 21:30

History, 27.08.2019 21:30