Business, 27.11.2019 00:31 QueenNerdy889

Initially, three firms a, b, and c share the market for a certain commodity. firm a has 30% of the market, firm b has 45%, and c has 25%. each year, the following changes occur:

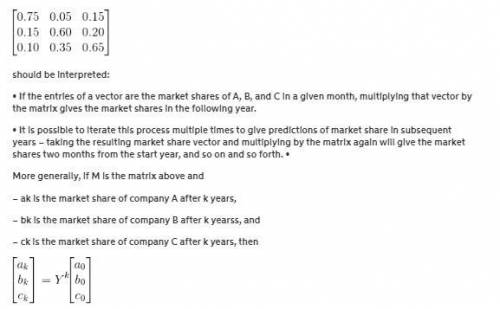

• a keeps 75% of its customers, while losing 15% to b and 10% to c.

• b keeps 60% of its customers, while losing 5% to a and 35% to c.

• c keeps 65% of its customers, while losing 15% to a and 20% to b.

(a) what is the current market share vector (ordered for a, b, and c)?

(b) find the transition matrix for this scenario.

(c) find the share of the market that each company has after two years.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 03:30, binodkharal2048

When the federal reserve buys and sells bonds to member banks, it is called a. monetary policy b. reserve ratio c. interest rate adjustment d. open market operations

Answers: 2

Business, 22.06.2019 12:20, ohgeezy

Consider 8.5 percent swiss franc/u. s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 12:50, emarquez05

Two products, qi and vh, emerge from a joint process. product qi has been allocated $34,300 of the total joint costs of $55,000. a total of 2,900 units of product qi are produced from the joint process. product qi can be sold at the split-off point for $11 per unit, or it can be processed further for an additional total cost of $10,900 and then sold for $13 per unit. if product qi is processed further and sold, what would be the financial advantage (disadvantage) for the company compared with sale in its unprocessed form directly after the split-off point?

Answers: 2

Business, 22.06.2019 16:40, jojo171717

Based on what you learned about time management which of these statements are true

Answers: 1

You know the right answer?

Initially, three firms a, b, and c share the market for a certain commodity. firm a has 30% of the m...

Questions in other subjects:

Social Studies, 22.07.2019 10:00

Health, 22.07.2019 10:00

Geography, 22.07.2019 10:00

Mathematics, 22.07.2019 10:00