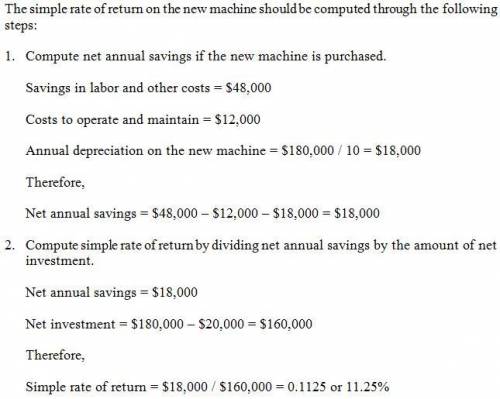

(ignore income taxes in this problem.) blaine corporation is considering replacing a technologically obsolete machine with a new state-of-the-art numerically controlled machine. the new machine would cost $180,000 and would have a ten-year useful life. unfortunately, the new machine would have no salvage value. the new machine would cost $12,000 per year to operate and maintain, but would save $48,000 per year in labor and other costs. the old machine can be sold now for scrap for $20,000. what is the simple rate of return on the new machine (round off your answer to the nearest one-hundredth of a percent)? select one:

1) 10.00%2) 26.67%3) 22.50%4) 11.25%show work

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 13:30, drippyc334

What do you recommend adam do to increase production in a business setting that does not seem to value high productivity?

Answers: 3

Business, 22.06.2019 19:20, needhelp243435

This problem has been solved! see the answerwhich of the following statements is correct? the consumer price index is a measure of the overall level of prices, whereas the gdp deflator is not a measure of the overall level of prices. if, in the year 2011, the consumer price index has a value of 123.50, then the inflation rate for 2011 must be 23.50 percent. compared to the gdp deflator, the consumer price index is the more common gauge of inflation. the consumer price index and the gdp deflator reflect the goods and services bought by consumers equally well.

Answers: 2

Business, 22.06.2019 22:50, tiffanibell71

Adding a complementary product to what is currently being produced is a demand management strategy used when: a. capacity exceeds demand for a product that has stable demand. b. price increases have failed to bring about demand management. c. demand exceeds capacity. d. demand exceeds 100 percent. e. the existing product has seasonal or cyclical demand.

Answers: 3

Business, 22.06.2019 23:10, wereallmadhere111

Amazon inc. does not currently pay a dividend. analysts expect amazon to commence paying annual dividends in three years. the first dividend is expected to be $2 per share. dividends are expected to grow from that point at an annual rate of 4% in perpetuity. investors expect a 12% return from the stock. what should the price of the stock be today?

Answers: 1

You know the right answer?

(ignore income taxes in this problem.) blaine corporation is considering replacing a technologically...

Questions in other subjects:

History, 23.07.2019 04:30

Mathematics, 23.07.2019 04:30

Biology, 23.07.2019 04:30

Social Studies, 23.07.2019 04:30

History, 23.07.2019 04:30

History, 23.07.2019 04:30