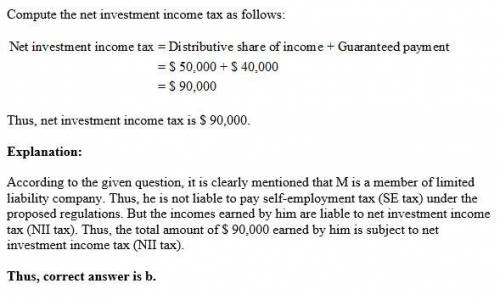

Meredith is a passive 30% member of the mno llc. she is not a managing member and she does not participate in any activities of the llc. her interest is more in the nature of an investment. in the current year, meredith's distributive share of income from the llc was $50,000. in addition, she received a guaranteed payment of $40,000 for the use of her capital. assume that her income from other sources exceeds $500,000. how much of meredith's llc income will be subject to the self-employment (se) tax (under the proposed regulations) and the net investment income (nii) tax? (disregard the additional medicare tax on upper-income taxpayers.)a.$90,000 se tax; $0 nii tax. b.$0 se tax; $90,000 nii tax. c.$50,000 se tax; $40,000 nii tax. d.$0 se tax; $0 nii tax. e.$0 se tax; $40,000 nii tax.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 08:30, cyaransteenberg

Blank is the internal operation that arranges information resources to support business performance and outcomes

Answers: 2

Business, 22.06.2019 10:30, kingyogii

The rybczynski theorem describes: (a) how commodity price changes influence real factor rewards (b) how commodity price changes influence relative factor rewards. (c) how changes in factor endowments cause changes in commodity outputs. (d) how trade leads to factor price equalization.

Answers: 1

You know the right answer?

Meredith is a passive 30% member of the mno llc. she is not a managing member and she does not parti...

Questions in other subjects:

English, 24.04.2020 19:53

Spanish, 24.04.2020 19:53

History, 24.04.2020 19:53

History, 24.04.2020 19:54

Physics, 24.04.2020 19:54