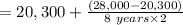

On january 1, 2018, wonderland sales issued $28,000 in bonds for $20,300. these are eight−year bonds with a stated interest rate of 13% and pay semiannual interest. wonderland sales uses the straightminus−line method to amortize the bond discount. what is the bond carrying amount after the first interest payment on june 30, 2018? (round your intermediate answers to the nearest dollar.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:30, Gghbhgy4809

An annuity that goes on indefinitely is called a perpetuity. the payments of a perpetuity constitute a/an series. the equation is: a stock with no maturity is an example of a perpetuity. quantitative problem: you own a security that provides an annual dividend of $170 forever. the security’s annual return is 9%. what is the present value of this security? round your answer to the nearest cent. $

Answers: 2

Business, 22.06.2019 08:00, shatj960

Suppose the number of equipment sales and service contracts that a store sold during the last six (6) months for treadmills and exercise bikes was as follows: treadmill exercise bike total sold 185 123 service contracts 67 55 the store can only sell a service contract on a new piece of equipment. of the 185 treadmills sold, 67 included a service contract and 118 did not.

Answers: 1

Business, 22.06.2019 19:40, jair512872

Lauer corporation uses the periodic inventory system and has provided the following information about one of its laptop computers: date transaction number of units cost per unit 1/1 beginning inventory 210 $ 910 5/5 purchase 310 $ 1,010 8/10 purchase 410 $ 1,110 10/15 purchase 255 $ 1,160 during the year, lauer sold 1,025 laptop computers. what was cost of goods sold using the lifo cost flow assumption?

Answers: 1

Business, 22.06.2019 21:00, kebo63

After hearing a knock at your front door, you are surprised to see the prize patrol from a large, well-known magazine subscription company. it has arrived with the good news that you are the big winner, having won $21 million. you have three options.(a) receive $1.05 million per year for the next 20 years.(b) have $8.25 million today.(c) have $2.25 million today and receive $750,000 for each of the next 20 years. your financial adviser tells you that it is reasonable to expect to earn 13 percent on investments.

Answers: 3

You know the right answer?

On january 1, 2018, wonderland sales issued $28,000 in bonds for $20,300. these are eight−year bonds...

Questions in other subjects:

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 08:01

Mathematics, 10.09.2020 09:01