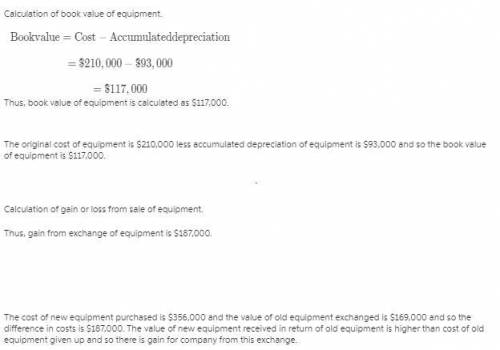

Equipment was acquired for $210,000 and has accumulated depreciation of $93,000. the business exchanges this equipment for new equipment. the new equipment has a market value of $304,000 and the business pays $52,000 cash. assume the exchange has commercial substance.

the exchange results in a:

(a) gain $187,000

(b) loss $187,000

(c) gain $135,000

(d) loss $135,000

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, saltyclamp

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 22.06.2019 00:40, tenleywood

The silverside company is considering investing in two alternative projects: project 1 project 2 investment $500,000 $240,000 useful life (years) 8 7 estimated annual net cash inflows for useful life $120,000 $40,000 residual value $32,000 $10,000 depreciation method straightminusline straightminusline required rate of return 11% 8% what is the accounting rate of return for project 2? (round any intermediary calculations to the nearest dollar, and round your final answer to the nearest hundredth of a percent, x. xx%.)

Answers: 3

You know the right answer?

Equipment was acquired for $210,000 and has accumulated depreciation of $93,000. the business exchan...

Questions in other subjects:

History, 20.09.2020 01:01

Physics, 20.09.2020 01:01

Mathematics, 20.09.2020 01:01

Mathematics, 20.09.2020 01:01

Mathematics, 20.09.2020 01:01