Consider the following information on stocks i and ii:

state of probability of rate of...

Business, 26.11.2019 05:31 jolleyrancher78

Consider the following information on stocks i and ii:

state of probability of rate of return if state occurs

economy state of economy stock i stock ii

recession .27 .030 ? .22

normal .62 .330 .14

irrational exuberance .11 .190 .42

the market risk premium is 11.2 percent, and the risk-free rate is 4.2 percent.

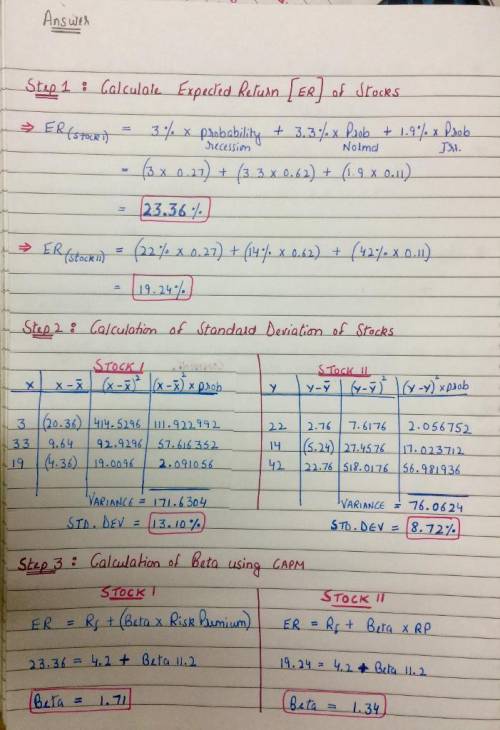

calculate the beta and standard deviation of stock i. (do not round intermediate calculations. enter the standard deviation as a percent and round both answers to 2 decimal places, e. g., 32.16.)

stock i

beta

standard deviation %

calculate the beta and standard deviation of stock ii. (do not round intermediate calculations. enter the standard deviation as a percent and round both answers to 2 decimal places, e. g., 32.16.)

stock ii

beta

standard deviation %

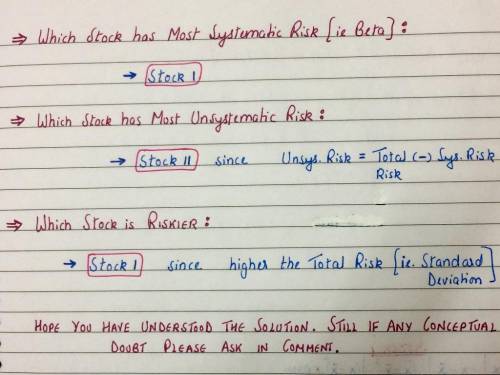

which stock has the most systematic risk?

stock i

stock ii

which one has the most unsystematic risk?

stock i

stock ii

which stock is "riskier"?

stock i

stock ii

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:00, nicoleaaliyah

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 12:10, felisha1234

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 20:00, Haddixhouse8948

How many organs are supplied at a zero price? (b) how many people die in the government-regulated economy where the government-set price ceiling is p = 0? the quantity qd – qa. the quantity qe – qa. the quantity qd – qe. (c) how many people die in the market-driven economy?

Answers: 1

You know the right answer?

Questions in other subjects:

Mathematics, 21.02.2021 05:20

Biology, 21.02.2021 05:20

Health, 21.02.2021 05:20

Health, 21.02.2021 05:20

Chemistry, 21.02.2021 05:20

Mathematics, 21.02.2021 05:20

Mathematics, 21.02.2021 05:20