Business, 26.11.2019 05:31 kornut7316

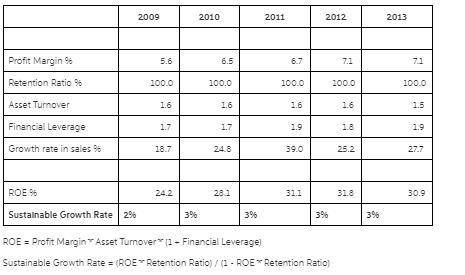

Under armour, inc. is an american supplier of sportswear and casual apparel. following are selected financial data for the company for the period 2009â2013.2009 2010 2011 2012 2013profit margin (%) 5.6 6.5 6.7 7.1 7.1 retention ratio (%) 100.0 100.0 100.0 100.0 100.0 asset turnover (x) 1.6 1.6 1.6 1.6 1.5 financial leverage (x) 1.7 1.7 1.9 1.8 1.9 growth rate in sales (%) 18.7 24.8 39.0 25.2 27.7 calculate under armourâs annual sustainable growth rate for the years 2009 through 2013. (round your answers to 1 decimal place.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:30, SophomoreSareke

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 12:50, iamhayls

In june 2009, at the trough of the great recession, the bureau of labor statistics announced that of all adult americans, 140,196,000 were employed, 14,729,000 were unemployed and 80,729,000 were not in the labor force. use this information to calculate: a. the adult population b. the labor force c. the labor-force participation rate d. the unemployment rate

Answers: 3

Business, 22.06.2019 17:50, nuggetslices

On january 1, eastern college received $1,350,000 from its students for the spring semester that it recorded in unearned tuition and fees. the term spans four months beginning on january 2 and the college spreads the revenue evenly over the months of the term. assuming the college prepares adjustments monthly, what amount of tuition revenue should the college recognize on february 28?

Answers: 2

Business, 22.06.2019 19:00, galfaro19

The east asiatic company (eac), a danish company with subsidiaries throughout asia, has been funding its bangkok subsidiary primarily with u. s. dollar debt because of the cost and availability of dollar capital as opposed to thai baht-denominated (b) debt. the treasurer of eac-thailand is considering a 1-year bank loan for $247,000.the current spot rate is b32.03 /$, and the dollar-based interest is 6.78% for the 1-year period. 1-year loans are 12.04% in baht. a. assuming expected inflation rates of 4.3 % and 1.24% in thailand and the united states, respectively, for the coming year, according to purchase power parity, what would the effective cost of funds be in thai baht terms? b. if eac's foreign exchange advisers believe strongly that the thai government wants to push the value of the baht down against the dollar by5% over the coming year (to promote its export competitiveness in dollar markets), what might the effective cost of funds end up being in baht terms? c. if eac could borrow thai baht at 13% per annum, would this be cheaper than either part (a) or part (b) above?

Answers: 2

You know the right answer?

Under armour, inc. is an american supplier of sportswear and casual apparel. following are selected...

Questions in other subjects:

Mathematics, 28.11.2020 22:50

English, 28.11.2020 22:50

Mathematics, 28.11.2020 22:50

Mathematics, 28.11.2020 22:50