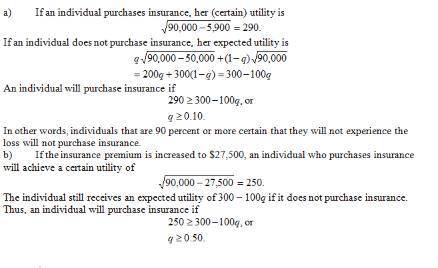

Consider a market of risk averse decision makers, each with a utility function u=√i each decision maker has an income of $90,000, but faces the possibility of a catastrophic loss of $50,000 in income. each decision maker can purchase an insurance policy that fully compensates her for her loss. this insurance policy has a cost of $5,900. suppose each decision maker potentially has a different probability p of experiencing the loss. a. what is the smallest value of p so that a decision maker purchases insurance? show your work. b. what would happen to this smallest value of p if the insurance company were to raise the insurance premium from $5,900 to $27,500?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 19:20, recon12759

Which of the following accurately describes a surplus? a. consumer demand for a certain car is below the number of cars that are produced. b. the production costs for a certain car are below the sale price of that car. c. a reduction in the cost of steel enables a car company to reduce the sale price of its cars. d. a car company tries to charge too high a price for a car and has to reduce the price. 2b2t

Answers: 1

Business, 22.06.2019 08:40, alvalynnw

Mcdonald's fast-food restaurants have a well-designed training program for all new employees. each new employee is supposed to learn how to perform standardized tasks required to maintain mcdonald's service quality. due to labor shortages in some areas, new employees begin work as soon as they are hired and do not receive any off-the-job training. this nonconformity to standards creates

Answers: 2

Business, 22.06.2019 17:30, Jermlew

Google started as one of many internet search engines, amazon started as an online book seller, and ebay began as a site where people could sell used personal items in auctions. these firms have grown to be so large and dominant that they are facing antitrust scrutiny from competition regulators in the us and elsewhere. did these online giants grow by fairly beating competition, or did they use unfair advantages? are there any clouds on the horizon for these firms -- could they face diseconomies of scale or diseconomies of scope as they continue to grow? if so, what factors may limit their continued growth?

Answers: 1

You know the right answer?

Consider a market of risk averse decision makers, each with a utility function u=√i each decision ma...

Questions in other subjects:

English, 26.04.2020 12:08

Mathematics, 26.04.2020 12:08

Mathematics, 26.04.2020 12:08

Mathematics, 26.04.2020 12:08

Mathematics, 26.04.2020 12:08