Business, 22.11.2019 23:31 swallowcaroline11

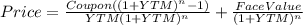

Adidas issued 10-year, 8% bonds with a par value of $200,000. interest is paid semiannually. the market rate on the issue date was 7.5%. adidas received $206,948 in cash proceeds. which of the following statements is true? a. adidas must pay $200,000 at maturity plus 20 interest payments of $8,000 each. b. adidas must pay $206,948 at maturity plus 20 interest payments of $8,000 each. c. adidas must pay $200,000 at maturity plus 20 interest payments of $7,500 each. d. adidas must pay $200,000 at maturity and no interest payments. e. adidas must pay $206,948 at maturity and no interest payments.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 14:10, Kittylover65

What sources about ecuador should you consult to obtain cultural information about this country that will need to be included in your cultural map?

Answers: 2

Business, 22.06.2019 04:50, ernie27

Neveready flashlights inc. needs $317,000 to take a cash discount of 3/15, net 70. a banker will loan the money for 55 days at an interest cost of $13,200. a. what is the effective rate on the bank loan? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) b. how much would it cost (in percentage terms) if the firm did not take the cash discount but paid the bill in 70 days instead of 15 days? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) c. should the firm borrow the money to take the discount? no yes d. if the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $317,000? e-1. what would be the effective interest rate in part d if the interest charge for 55 days were $7,200?

Answers: 3

Business, 22.06.2019 12:50, cece4874

Suppose the real risk-free rate and inflation rate are expected to remain at their current levels throughout the foreseeable future. consider all factors that affect the yield curve. then identify which of the following shapes that the u. s. treasury yield curve can take. check all that apply.

Answers: 2

You know the right answer?

Adidas issued 10-year, 8% bonds with a par value of $200,000. interest is paid semiannually. the mar...

Questions in other subjects:

Spanish, 11.12.2019 17:31

Mathematics, 11.12.2019 17:31

Computers and Technology, 11.12.2019 17:31