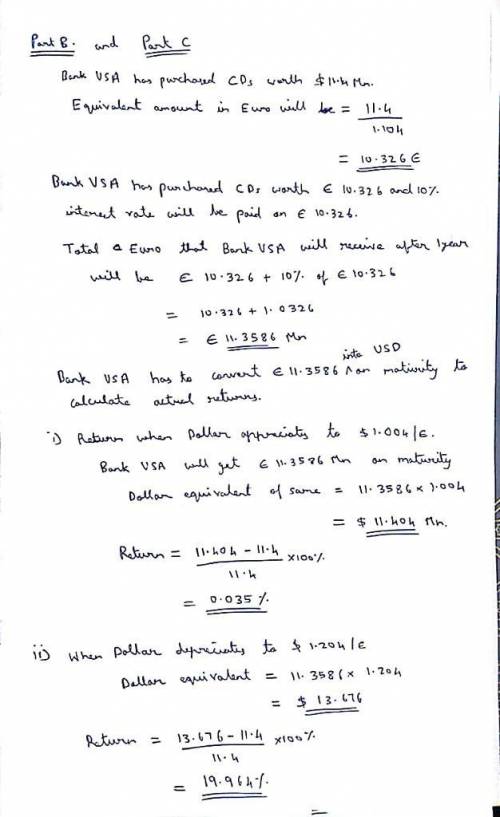

Bank usa recently purchased $11.4 million worth of euro-denominated one-year cds that pay 10 percent interest annually. the current spot rate of u. s. dollars for euros is $1.104/€1. a. is bank usa exposed to an appreciation or depreciation of the dollar relative to the euro? b. what will be the return on the one-year cd if the dollar appreciates relative to the euro such that the spot rate of u. s. dollars for euros at the end of the year is $1.004/€1? (round your answer to 3 decimal places. (e. g., 32.161)) c. what will be the return on the one-year cd if the dollar depreciates relative to the euro such that the spot rate of u. s. dollars for euros at the end of the year is $1.204/€1? (round your answer to 3 decimal places. (e. g., 32.161))

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:40, shybug886

Newton industries is considering a project and has developed the following estimates: unit sales = 4,800, price per unit = $67, variable cost per unit = $42, annual fixed costs = $11,900. the depreciation is $14,700 a year and the tax rate is 34 percent. what effect would an increase of $1 in the selling price have on the operating cash flow?

Answers: 2

Business, 22.06.2019 10:20, LadyHolmes67

Sye chase started and operated a small family architectural firm in 2016. the firm was affected by two events: (1) chase provided $25,000 of services on account, and (2) he purchased $2,800 of supplies on account. there were $250 of supplies on hand as of december 31, 2016. record the two transactions in the accounts. record the required year-end adjusting entry to reflect the use of supplies and the required closing entries. post the entries in the t-accounts and prepare a post-closing trial balance.

Answers: 1

Business, 22.06.2019 13:10, legendman27

Laval produces lamps and home lighting fixtures. its most popular product is a brushed aluminum desk lamp. this lamp is made from components shaped in the fabricating department and assembled in the assembly department. information related to the 22,000 desk lamps produced annually follows. direct materials $280,000direct labor fabricating department (8,000 dlh × $24 per dlh) $192,000assembly department (16,600 dlh × $26 per dlh) $431,600machine hours fabricating department $15,200mhassembly department $20,850mhexpected overhead cost and related data for the two production departments follow. fabricating assemblydirect labor hours 150,000dlh 295,000dlhmachine hours 161,000mh 128,000mhoverhead cost $400,000 430,000required1. determine the plantwide overhead rate for laval using direct labor hours as a base.2. determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate.3. compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department.4. use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps.

Answers: 3

You know the right answer?

Bank usa recently purchased $11.4 million worth of euro-denominated one-year cds that pay 10 percent...

Questions in other subjects:

Mathematics, 09.04.2021 02:20

Chemistry, 09.04.2021 02:20

Spanish, 09.04.2021 02:20

Mathematics, 09.04.2021 02:20

Mathematics, 09.04.2021 02:20

Mathematics, 09.04.2021 02:20