Business, 22.11.2019 01:31 iicekingmann

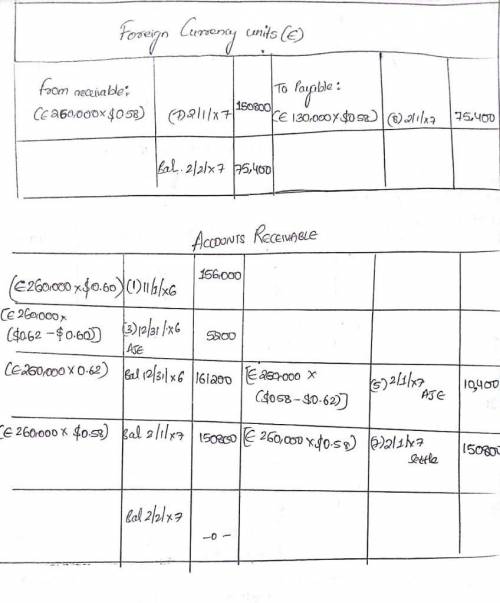

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sold goods to a company located in munich, germany. the receivable was to be settled in european euros on february 1, 20x7, with the receipt of €190,000 by merchant company. on november 1, 20x6, merchant purchased machine parts from a company located in berlin, germany. merchant is to pay €95,000 on february 1, 20x7. the direct exchange rates are as follows: november 1, 20x6 €1 = $ 0.60 december 31, 20x6 €1 = $ 0.62 february 1, 20x7 €1 = $ 0.58 required: record the t-accounts for the following transactions (record the transactions in the given order.) the november 1, 20x6, export transaction (sale). the november 1, 20x6, import transaction (purchase). the december 31, 20x6, year-end adjustment required of the foreign currency–denominated receivable of €190,000. the december 31, 20x6, year-end adjustment required of the foreign currency–denominated payable of €95,000. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency receivable on that date. the february 1, 20x7, adjusting entry to determine the u. s. dollar–equivalent value of the foreign currency payable on that date. the february 1, 20x7, settlement of the foreign currency receivable. the february 1, 20x7, settlement of the foreign currency payable.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:00, joannegrace869

Which of the following statements is correct? a. two firms with identical sales and operating costs but with different amounts of debt and tax rates will have different operating incomes by definition. b. free cash flow (fcf) is, essentially, the cash flow that is available for interest and dividends after the company has made the investments in current and fixed assets that are necessary to sustain ongoing operations. c. retained earnings as reported on the balance sheet represent cash and, therefore, are available to distribute to stockholders as dividends or any other required cash payments to creditors and suppliers. d. if a firm is reporting its income in accordance with generally accepted accounting principles, then its net income as reported on the income statement should be equal to its free cash flow. e. after-tax operating income is calculated as ebit(1 - t) + depreciation.

Answers: 2

Business, 22.06.2019 10:10, sydc1215

At the end of year 2, retained earnings for the baker company was $3,550. revenue earned by the company in year 2 was $3,800, expenses paid during the period were $2,000, and dividends paid during the period were $1,400. based on this information alone, retained earnings at the beginning of year 2 was:

Answers: 1

Business, 22.06.2019 13:40, deezzzy

After much consideration, you have chosen cancun over ft. lauderdale as your spring break destination this year. however, spring break is still months away, and you may reverse this decision. which of the following events would prompt you to reverse this decision? a. the marginal cost of going to cancun decreases. b. the marginal cost of going to ft. lauderdale decreases. c. the marginal benefit of going to cancun increases. d. the marginal benefit of going to ft. lauderdale decreases.

Answers: 2

Business, 22.06.2019 17:40, rave35

Croy inc. has the following projected sales for the next five months: month sales in units april 3,850 may 3,875 june 4,260 july 4,135 august 3,590 croy’s finished goods inventory policy is to have 60 percent of the next month’s sales on hand at the end of each month. direct material costs $2.50 per pound, and each unit requires 2 pounds. raw materials inventory policy is to have 50 percent of the next month’s production needs on hand at the end of each month. raw materials on hand at march 31 totaled 3,741 pounds. 1. determine budgeted production for april, may, and june. 2. determine the budgeted cost of materials purchased for april, may, and june. (round your answers to 2 decimal places.)

Answers: 3

You know the right answer?

Merchant company had the following foreign currency transactions: on november 1, 20x6, merchant sol...

Questions in other subjects:

History, 01.02.2021 21:10

Mathematics, 01.02.2021 21:10

Computers and Technology, 01.02.2021 21:10

Mathematics, 01.02.2021 21:10

History, 01.02.2021 21:10

Mathematics, 01.02.2021 21:10

Mathematics, 01.02.2021 21:10