Business, 21.11.2019 21:31 camosloppy3150

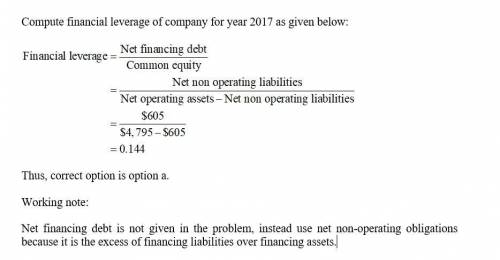

The fiscal 2017 financial statements of reed enterprises shows average net operating assets (noa) of $4,795 million, average net nonoperating obligations (nno) of $605 million, average total liabilities of $6,330 million, and year-end equity of $5,240 million. ) to ber ugh eria e company's 2017 financial leverage (flev) is a) 0.144 b. 0.126c. 0.115 d. 0.091 e) there is not enough information to determine the ratio.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 20:00, gudtavosanchez19

After testing its water, a city water department issues a report to the related citizens, noting what chemicals have been identified, their doses, and the estimated risks of exposure at these levels. this report represents a type of

Answers: 1

Business, 22.06.2019 21:10, elijahedgar876

Which statement or statements are implied by equilibrium conditions of the loanable funds market? a firm borrowing in the loanable funds market invests those funds with a higher expected return than any firm that is not borrowing. investment projects which use borrowed funds are guaranteed to be profitable even after paying interest expenses. the quantity of savings is maximized, thus the quantity of investment is maximized. a loan is made at the minimum interest rate of all current borrowing.

Answers: 3

You know the right answer?

The fiscal 2017 financial statements of reed enterprises shows average net operating assets (noa) of...

Questions in other subjects:

English, 10.05.2021 19:30

Mathematics, 10.05.2021 19:30

Chemistry, 10.05.2021 19:30

Social Studies, 10.05.2021 19:30

Mathematics, 10.05.2021 19:30

Mathematics, 10.05.2021 19:30